The current XRP price is a hot topic among traders and investors as speculation mounts about its future trajectory. Recently, XRP price has shown volatility, dropping 4% in just one day and trading as low as $3.02. This decline raises questions about whether XRP price predictions will hold true or if a more significant price drop is on the horizon. Moreover, the emergence of a bull flag pattern suggests a potential rebound, with optimistic analysts eyeing a target of $4.60. As XRP trading trends evolve, understanding the underlying factors influencing XRP analysis is crucial for making informed decisions.

In recent weeks, the valuation of XRP has captured the attention of market participants, igniting discussions around its potential movements. Observers are keenly analyzing the fluctuations in XRP’s value, particularly following a recent downturn that has left many wondering about its future. The ongoing assessment of XRP’s market performance includes examining its price trends and potential recovery patterns, especially in light of the current bearish sentiment. With various indicators pointing to a possible rebound, investors are closely monitoring the situation for signs of a bullish reversal. The interplay of these factors is essential in determining XRP’s path forward.

Understanding the Current XRP Price Trends

XRP price has been a hot topic among traders and investors, especially following its recent volatility. After reaching impressive highs, many are left wondering about the future direction of XRP. Currently, the XRP price is showing signs of weakness, having dropped by 4% in just one day. Observing these trends is crucial for anyone looking to invest or trade in XRP, as they may indicate potential shifts in market sentiment.

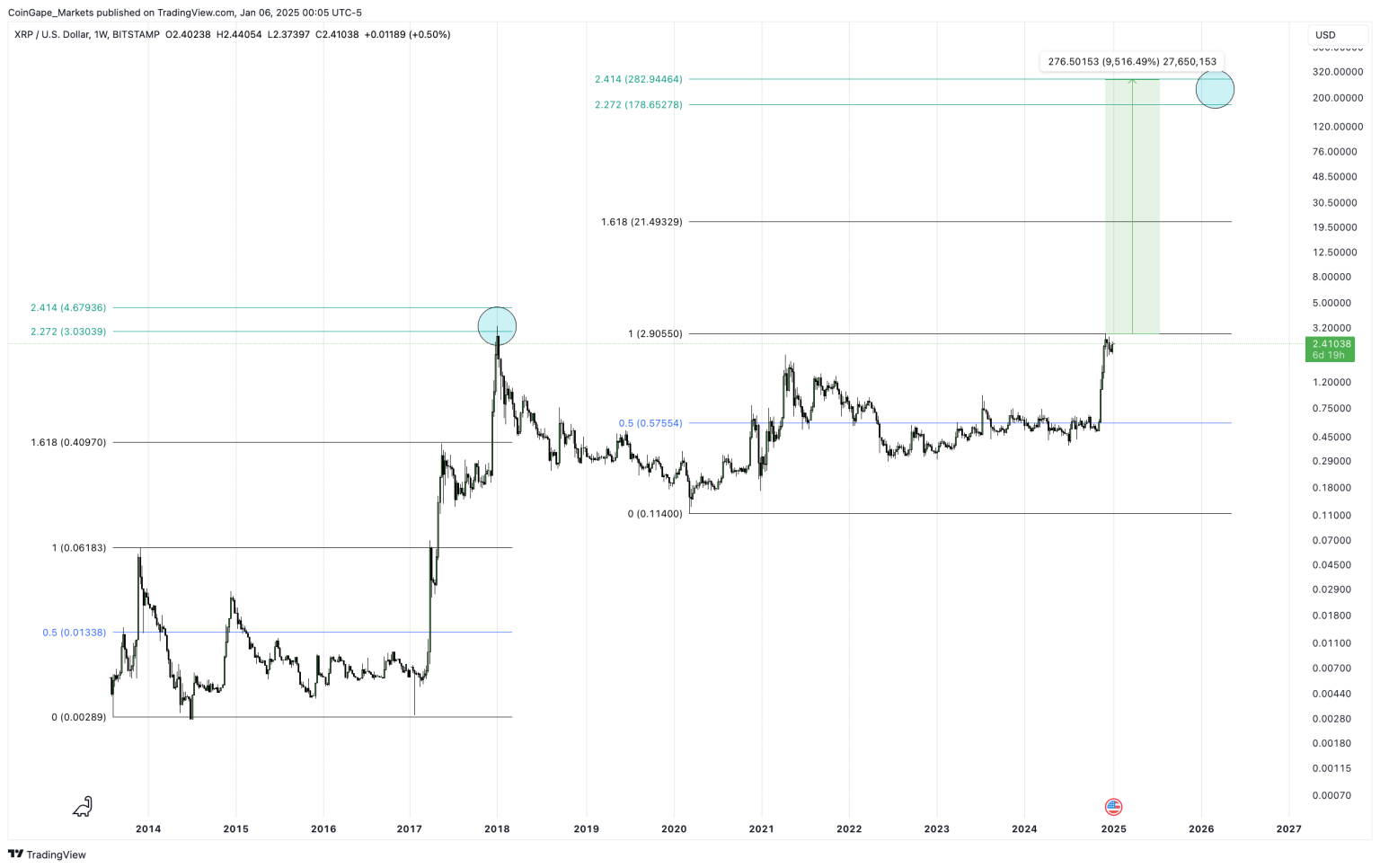

To further analyze the XRP price, we must also consider the historical context. The current price movement is reminiscent of the 2018 correction, where XRP saw a significant price drop after reaching a peak. Understanding these patterns and applying technical analysis tools can help traders gauge whether this trend will continue or if a rebound is on the horizon.

XRP Price Prediction: What Lies Ahead?

When predicting the future of XRP price, it’s essential to reference current market conditions and technical indicators. The symmetrical triangle formation that XRP is currently exhibiting suggests a potential breakout point, making it a focal point for price predictions. If XRP breaks below the lower trendline, we could see prices dip toward the $2.50 mark, which aligns with a bearish outlook.

Conversely, should XRP manage to break above the upper trendline, there is a bullish target of $3.75 on the horizon. This duality presents both risks and opportunities for traders, highlighting the importance of staying informed on price movements and market sentiment.

Analyzing XRP’s Bull Flag Formation

The XRP bull flag pattern has emerged after a strong rally, providing traders with insights into potential future movements. The consolidation phase within the bull flag indicates a moment of pause before another possible upward trend. If XRP can maintain its position above critical support levels, there’s an upside target of approximately $4.60, making this pattern an essential aspect of XRP price analysis.

Understanding this bull flag requires recognizing its structure: following a significant price increase, XRP’s price has entered a descending parallel channel. Traders should monitor the upper boundary of the flag, as a breakout here could indicate a renewed bullish momentum, paving the way for a significant price increase.

The Impact of Trading Trends on XRP Price

Trading trends play a pivotal role in determining the XRP price. Recent data reveals a declining number of active XRP wallets, which correlates with higher selling pressure in the market. This trend indicates that many holders are cashing out after the recent rally, leading to a potential price decrease. A continuous drop in active addresses could further exacerbate the situation, pushing XRP price lower.

In addition, understanding these trading trends can help predict market behavior. If the downward trend in wallet activity continues, it could suggest a lack of confidence among investors, leading to increased volatility and possible price drops in the near future.

XRP Price Analysis: Key Support and Resistance Levels

Analyzing XRP’s price involves identifying significant support and resistance levels that dictate future movements. Currently, the 50-day exponential moving average (EMA) at $2.57 serves as a critical support level. If XRP price breaches this level, it could signal further declines, potentially reaching $2.50.

On the other hand, resistance is observed near the $3.30 mark, where the upper boundary of the bull flag lies. A successful breakout above this resistance could lead to a rally towards the $3.75 mark, indicating a bullish reversal and renewed interest from investors.

Market Sentiment Surrounding XRP

Market sentiment is a crucial factor influencing XRP price. Recent trends show a bearish sentiment prevailing among investors, as indicated by the drop in active wallet addresses. A significant decline in trading activity often precedes price drops, reinforcing the need to monitor sentiment closely.

Understanding investor behavior is vital for forecasting future price movements. If the market sentiment shifts towards bullishness, we could see an influx of new investors, potentially driving the XRP price higher. Conversely, if bearish sentiment continues, it could lead to further losses.

XRP Price Drop: Causes and Effects

The recent XRP price drop can be attributed to several factors, including profit-taking by investors and declining market activity. After reaching seven-year highs, many traders opted to sell, resulting in a 10% price decrease over a short period. This behavior often reflects a broader trend in the cryptocurrency market, where volatility can lead to rapid price changes.

Additionally, the overall sentiment in the cryptocurrency market can exacerbate these price drops. External factors such as regulatory news, technological developments, or macroeconomic trends can influence investor behavior, further impacting the XRP price.

XRP Price Consolidation: Is a Breakout Imminent?

XRP is currently experiencing a consolidation phase, which often precedes a breakout. Traders are closely watching the price movements within the symmetrical triangle formation, as this will determine the next significant price action. A breakout from this pattern could lead to either a bullish or bearish scenario, making it a critical point for traders.

The potential for a breakout is heightened by the recent price trends and market analysis. If XRP can maintain its position and break above resistance levels, it could signal a new bullish trend, while a breakdown could indicate further declines. Traders should remain vigilant during this consolidation phase.

XRP Trading Strategies for Investors

Investors looking to trade XRP should consider various strategies to navigate the current market landscape. Utilizing technical analysis tools, such as trendlines and moving averages, can help identify potential entry and exit points. Additionally, keeping abreast of market sentiment and trading volume can provide valuable insights into potential price movements.

Moreover, diversification and risk management are vital components of any trading strategy. By spreading investments across different cryptocurrencies, investors can mitigate risks associated with price volatility in XRP. Continuous research and analysis will empower investors to make informed decisions in the ever-changing crypto market.

| Key Point | Details |

|---|---|

| Current XRP Price | $3.02 as of January 29, with a 4% drop over the previous day. |

| Potential Price Drop | Technical analysis suggests a drop to $2.50 based on symmetrical triangle breakdown. |

| Historical Comparison | Current trends resemble the December 2024 – January 2025 price consolidation. |

| Market Sentiment | Decreased number of wallets holding XRP indicates bearish sentiment. |

| Bull Flag Pattern | Current trading suggests a potential bullish rebound if support holds at $3.30. |

| Upside Target | If the bull flag holds, XRP could rise to $4.60, representing a 52% increase. |

Summary

The XRP price is currently under scrutiny as it faces potential declines following a recent high. With technical indicators suggesting a possible drop to $2.50, the market appears to be leaning towards a bearish outlook. However, there remains a bullish sentiment due to the formation of a bull flag pattern that could lead to a price surge towards $4.60 if key support levels are maintained. Investors should monitor these developments closely, as XRP’s price trajectory continues to evolve.