Bitcoin difficulty has recently surged by an impressive 5.61%, reaching a staggering 114.17 trillion at block height 883,008. This increase highlights the ever-evolving landscape of Bitcoin mining difficulty, where the computational challenges faced by miners are growing increasingly complex. As the Bitcoin hash rate fluctuates, it directly impacts the dynamics of cryptocurrency mining, making it essential for miners to adapt their strategies continuously. Blockchain technology underpins these changes, as it regulates the intricate process of block validation and transaction confirmations. With the latest Bitcoin network analytics revealing these shifts, it becomes clear that understanding Bitcoin difficulty is crucial for anyone involved in the cryptocurrency ecosystem.

The recent spike in Bitcoin mining complexity has set a new benchmark, with miners now facing unprecedented challenges in their quest to validate transactions. This alteration in the mining environment signals a shift in the fundamental mechanics of the Bitcoin network, where the increasing hash rate plays a pivotal role in determining the level of difficulty. As miners engage in this competitive landscape, the underlying blockchain infrastructure becomes even more critical, ensuring that each transaction is processed efficiently and securely. The interplay between mining difficulty and the overall performance of the network showcases the dynamic nature of digital currencies, emphasizing the importance of adapting to these changes. Overall, comprehending the intricacies of Bitcoin’s mining process is essential for stakeholders looking to navigate this volatile yet rewarding market.

Understanding Bitcoin Mining Difficulty

Bitcoin mining difficulty is a critical metric that reflects how challenging it is to mine new blocks in the Bitcoin blockchain. As of the latest update, the difficulty has surged to an astonishing 114.17 trillion, marking a 5.61% increase. This rise indicates that miners must now solve increasingly complex mathematical puzzles to validate transactions and maintain the integrity of the blockchain. Such adjustments are fundamental to Bitcoin’s protocol, ensuring that blocks are mined at a relatively stable rate, despite fluctuations in the number of miners participating in the network.

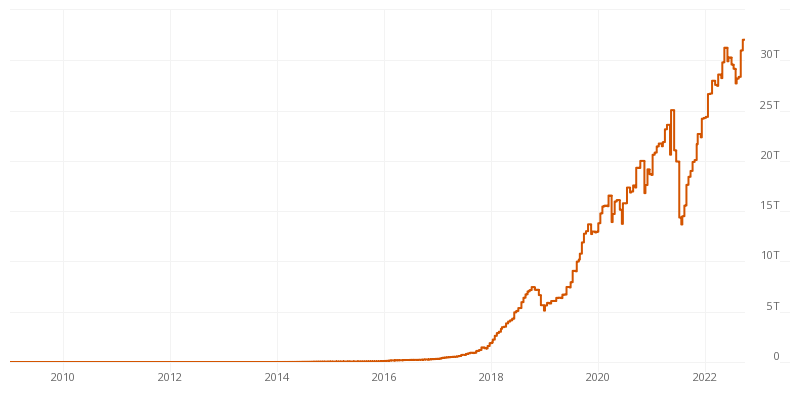

To grasp the significance of Bitcoin mining difficulty, it’s essential to recognize its relationship with the Bitcoin hash rate. The hash rate, currently at 819.21 EH/s, dictates the overall computational power being utilized to mine Bitcoin. When difficulty increases, it means that the network is accommodating more miners or that existing miners are employing more advanced hardware capable of solving these intricate algorithms. This dynamic interplay between difficulty and hash rate not only influences miners’ profitability but also impacts the overall security and stability of the Bitcoin network.

Impact of Rising Bitcoin Difficulty on Miners

The recent spike in Bitcoin mining difficulty poses a considerable challenge for miners, especially those operating with less sophisticated equipment. As the difficulty level reaches 114.17 trillion, the computational demands on miners have escalated significantly. This means that even established miners with high hash rates must continuously upgrade their hardware to remain competitive. For smaller miners, the economic viability of mining can come into question, as the costs of electricity and equipment may outweigh the potential rewards from mining.

Furthermore, the increase in difficulty can lead to a consolidation within the mining industry. Larger mining pools, like Foundry, which provides an overwhelming hash rate of 257 quintillion hashes per second, can absorb the impact of difficulty spikes much more effectively than smaller operations. Consequently, as competition intensifies, the landscape of cryptocurrency mining may shift, with fewer players dominating the market. This consolidation can have broader implications for the decentralization ethos that Bitcoin was originally founded upon.

The Role of Hash Rate in Bitcoin Mining

The hash rate is a pivotal factor in Bitcoin mining, representing the total computational power being utilized to validate transactions on the blockchain. A high hash rate often correlates with an increase in mining difficulty, as it indicates that more miners are competing to solve the Bitcoin algorithm. Currently, the hash rate sits at 819.21 EH/s, which has seen a noticeable drop of 32.79 EH/s since early February 2025. This fluctuation not only affects the network’s overall security but also the speed at which transactions can be confirmed.

Moreover, the hash rate serves as a barometer for the health of the Bitcoin network. When the hash rate decreases, it may suggest that miners are exiting the market due to lower profitability or increasing operational costs. Conversely, an increasing hash rate can signify a growing interest in Bitcoin mining and an influx of new miners entering the market. Understanding these trends is crucial for all stakeholders in the cryptocurrency ecosystem, as they directly influence the efficiency and viability of Bitcoin as a decentralized digital currency.

Blockchain Technology and Its Effect on Mining Difficulty

Blockchain technology underpins the entire Bitcoin network, allowing for secure and transparent transaction verification. The protocol’s inherent design includes mechanisms that adjust the mining difficulty based on the network’s current hash rate. As the hash rate increases, the Bitcoin network automatically raises the difficulty to ensure that blocks are added at a consistent rate, typically around every ten minutes. This self-regulating feature is one of the many innovative aspects of blockchain technology that enhances its robustness.

As Bitcoin continues to evolve, the relationship between blockchain technology and mining difficulty becomes increasingly complex. Innovations in hardware, such as more efficient ASIC miners, can lead to surges in hash rate, which in turn may prompt further adjustments in difficulty. This intricate balance between technological advancements and network adjustments is essential for maintaining the integrity and security of the Bitcoin blockchain, ensuring that it can withstand the test of time in an ever-changing digital landscape.

Bitcoin Network Analytics: Keeping Track of Mining Trends

Bitcoin network analytics plays a crucial role in understanding the trends and dynamics of the cryptocurrency mining landscape. With the latest updates indicating a 5.61% increase in mining difficulty, network analytics can help miners and investors track changes in hash rate, transaction volume, and overall network health. By analyzing these metrics, stakeholders can make informed decisions about their mining operations and investment strategies, optimizing their approach to navigate the volatile crypto market.

Furthermore, network analytics can provide insights into the behavior of different mining pools and their contributions to the overall hash rate. For instance, as mentioned, Foundry leads the pack with an extraordinary hash rate contribution, which underscores the competitive nature of the mining ecosystem. By leveraging data from network analytics, miners can better understand their position within the market and adapt to the shifting challenges posed by increasing mining difficulty and fluctuating hash rates.

Challenges Faced by Small-Scale Miners

Small-scale miners face significant hurdles in the current Bitcoin mining landscape, particularly with the recent spike in mining difficulty. As the difficulty climbs to 114.17 trillion, these miners must generate an overwhelming number of hashes to compete effectively. For many, this creates a disparity in operational efficiency compared to larger mining pools that can afford the latest technology and infrastructure. Consequently, small miners may find their profitability dwindling as they struggle to keep pace with the evolving demands of Bitcoin mining.

Additionally, the energy costs associated with mining have become a pressing concern for small miners. With the increased difficulty, the amount of computational power needed to mine a single block has risen, leading to higher electricity consumption. Many small-scale miners are now reevaluating their business models, as the costs of mining may exceed the rewards, especially during periods of low Bitcoin prices. This economic pressure has prompted some to consider alternative strategies, such as joining mining pools, to mitigate risks and enhance their chances of success.

The Future of Bitcoin Mining Amidst Rising Difficulty

As Bitcoin difficulty reaches unprecedented levels, the future of Bitcoin mining is poised for transformation. The steady increase in difficulty indicates a growing network that is both robust and competitive. However, this evolution raises questions about the sustainability of mining practices and the environmental impact associated with high energy consumption. As miners face mounting pressure to remain profitable, the industry may witness a shift toward more sustainable practices, such as utilizing renewable energy sources for mining operations.

Moreover, advancements in technology and mining hardware will play a pivotal role in shaping the future of Bitcoin mining. The emergence of more efficient ASIC miners and better cooling solutions could help miners cope with rising difficulty levels while reducing their operational costs. Additionally, the integration of artificial intelligence and machine learning in mining operations may optimize performance and enhance decision-making processes. Ultimately, the future of Bitcoin mining will depend on the industry’s ability to adapt to changing challenges while maintaining the foundational principles of decentralization and security.

The Economic Implications of Bitcoin Mining Difficulty

The economic implications of rising Bitcoin mining difficulty extend beyond individual miners to affect the broader cryptocurrency market. An increase in difficulty typically leads to a decrease in the number of miners who can profitably operate, which can have a ripple effect on mining equipment manufacturers and the energy sector. As the barriers to entry become steeper, fewer new miners may enter the market, potentially leading to a decrease in competition and innovation within the mining space.

Additionally, as mining difficulty escalates, there is an inherent risk of centralization, where only a handful of large mining operations dominate the network. This centralization could undermine the decentralized ethos that Bitcoin was built upon, raising concerns among the community regarding fairness and security. The economic landscape of Bitcoin mining is thus interwoven with questions of sustainability, profitability, and the future of decentralized finance as a whole.

Strategies for Navigating Increased Mining Difficulty

In light of the recent increase in Bitcoin mining difficulty, miners must adopt strategic approaches to remain competitive and profitable. One effective strategy is to invest in cutting-edge mining hardware that offers higher efficiency and lower power consumption. By utilizing the latest ASIC miners, miners can maximize their hash rate output while minimizing their energy costs, allowing them to sustain operations even as difficulty rises.

Additionally, joining mining pools can provide smaller miners with a viable path to success amid heightened competition. By pooling resources and sharing the rewards, miners can improve their chances of earning Bitcoin despite facing increased difficulty. This collaborative approach not only enhances profitability but also fosters a sense of community within the mining ecosystem, ensuring that even small-scale operations can thrive in the face of adversity.

| Key Point | Details |

|---|---|

| Bitcoin Difficulty Increase | Bitcoin difficulty surged by 5.61% to reach 114.17 trillion at block height 883,008. |

| Impact on Miners | Miners face heightened challenges as the computational effort required to validate transactions has increased significantly. |

| Hashrate | The current hashrate is 819.21 EH/s, down by 32.79 EH/s since February 7, 2025. |

| Mining Complexity | Mining Bitcoin is now 114.17 trillion times more complex than at the network’s inception in 2009. |

| Block Time | Despite the increased difficulty, the average block time is currently around 9 minutes and 29 seconds. |

| Mining Pool Contributions | 73 entities contribute at least 54.62 KH/s to the network, while Foundry leads with 257 quintillion hashes per second. |

Summary

Bitcoin difficulty has reached unprecedented levels, currently sitting at an astounding 114.17 trillion after a 5.61% increase. This spike indicates the growing complexity and resource demands for miners, making it essential for them to adapt to the evolving landscape of Bitcoin mining. The dynamic adjustments in the Bitcoin protocol ensure that the network remains secure, but they also present significant challenges to miners, especially as the hashrate fluctuates. As transactional activity slows down, miners must strategize effectively to stay competitive in this increasingly challenging environment.