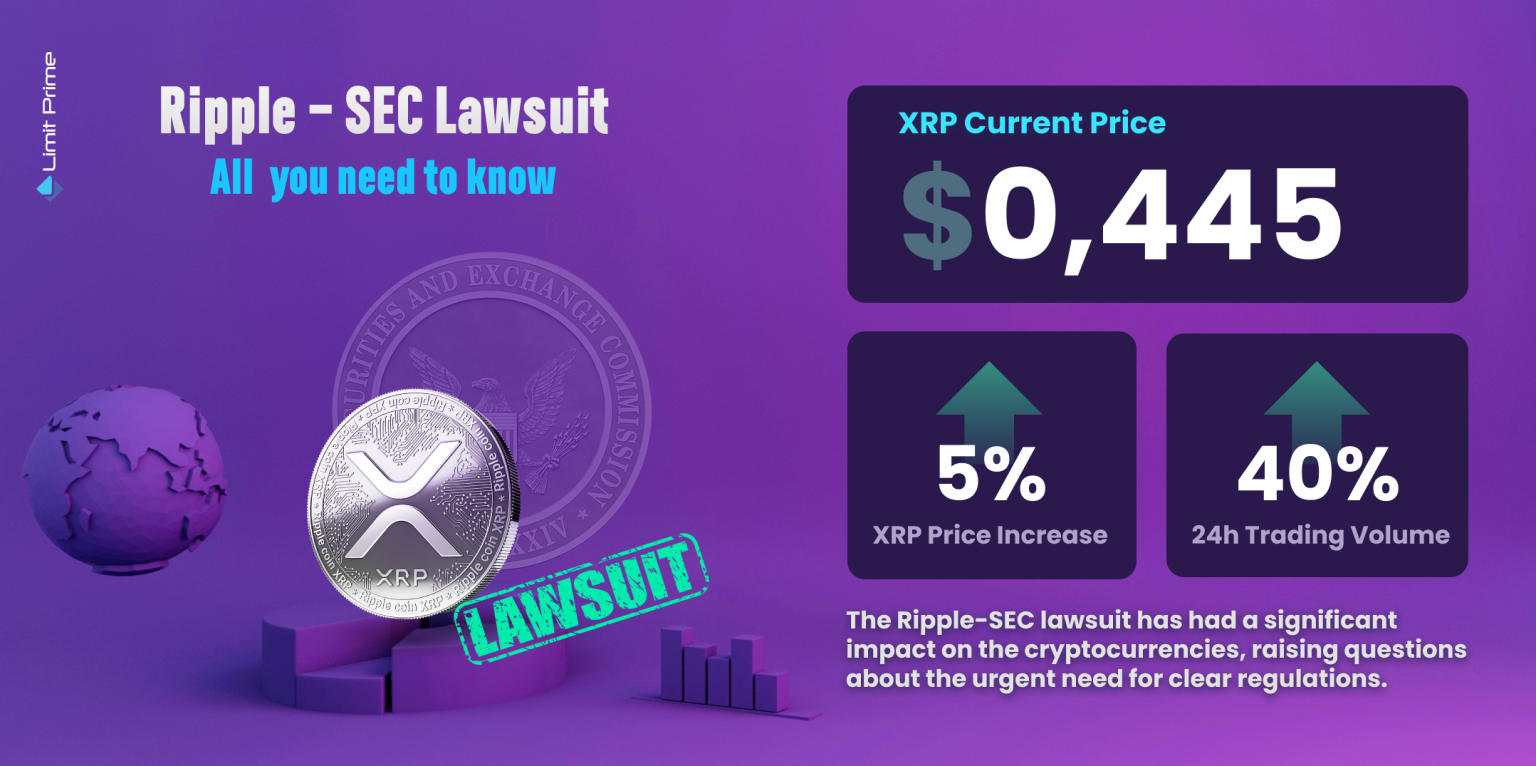

The Ripple Labs SEC dispute has emerged as one of the most significant legal battles in the cryptocurrency world, capturing the attention of investors and regulators alike. Ripple Labs, the company behind the popular digital currency XRP, is currently embroiled in an ongoing SEC lawsuit that questions the legality of its token sales. In a recent development, Ripple has formally requested a deadline for its cross-appeal brief, indicating its determination to fight back against the SEC’s claims. This contentious XRP legal battle highlights the broader issues surrounding crypto regulation and the implications for other digital assets. As both sides prepare for the next phase of this dispute, the outcome could set a precedent for how cryptocurrencies are classified and regulated in the future.

At the heart of the legal contention between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) lies a complex web of allegations regarding the status of XRP. The ongoing conflict, often referred to as the XRP legal battle, raises essential questions about the classification of cryptocurrencies and their compliance with federal securities laws. Ripple’s recent actions, including its request for a deadline on the cross-appeal brief, showcase its commitment to challenging the SEC’s position and navigating the intricate landscape of crypto regulation. As this case unfolds, many are closely watching how the judiciary will interpret the nuances of digital currencies, which could have far-reaching effects on the entire crypto ecosystem. The implications of this case extend beyond Ripple; they may influence future policies and enforcement actions by regulatory bodies across the nation.

Overview of the Ripple Labs SEC Dispute

The legal battle between Ripple Labs and the SEC has been ongoing since December 2020, when the SEC accused Ripple of conducting an unregistered securities offering through the sale of its XRP cryptocurrency. This lawsuit has significant implications for the broader cryptocurrency market, as it seeks to clarify the regulatory status of digital assets. Ripple’s recent request for an April 16 deadline for its cross-appeal brief underscores the ongoing nature of this dispute and highlights the procedural steps involved in appealing a court decision.

The SEC’s contention that XRP should be classified as a security has sparked intense debate within the crypto community. Ripple’s position, supported by a favorable ruling from the New York District Court in 2023, argues that XRP sold to retail investors does not fit the criteria of a security. As Ripple continues to navigate this complex legal landscape, the outcome of this case could set a precedent for how cryptocurrencies are regulated in the future.

| Key Point | Details |

|---|---|

| Ripple’s Deadline Request | Ripple Labs requested an April 16 deadline for its cross-appeal brief. |

| Legal Procedure | This request is considered a standard legal procedure. |

| Support from Executives | CEO Brad Garlinghouse and co-founder Chris Larsen support the deadline request. |

| SEC’s Argument | The SEC filed on January 15, arguing the court erred in ruling XRP not a security. |

| Court Ruling Context | The New York District Court ruled XRP sold to retail investors is not a security. |

| Ripple’s Financial Penalty | Ripple was ordered to pay over $125 million to the SEC for breaching securities laws. |

| Ongoing Speculation | Observers speculate if the SEC might withdraw the case. |

| SEC Leadership Changes | Mark Uyeda, a crypto-friendly acting Chair, is leading the SEC since January 20. |

| Timeline of the Lawsuit | The SEC lawsuit against Ripple was first filed in December 2020. |

Summary

The Ripple Labs SEC dispute continues to be a pivotal issue in the cryptocurrency landscape. Ripple Labs has formally requested an April 16 deadline for its cross-appeal brief, adhering to standard legal procedures. This ongoing legal battle underscores the complexities of cryptocurrency regulation and the implications of the SEC’s actions on the future of digital assets.