The topic of Crypto Adoption by Financial Advisers is gaining significant traction as the financial landscape evolves. With the recent launch of crypto exchange-traded funds (ETFs), financial advisers are positioned as critical players in facilitating the wider acceptance of cryptocurrencies among their clients. As registered investment advisers (RIAs) begin to explore innovative investment strategies involving crypto, they hold the potential to drive substantial inflows into the sector. Despite the current skepticism from many advisers regarding the volatility and regulatory uncertainties surrounding digital assets, the demand from clients for exposure to cryptocurrencies is undeniable. This pivotal moment marks a transformative phase for financial advisers, as they navigate the complexities of integrating crypto ETFs into their clients’ portfolios to enhance their overall investment strategies.

The growing interest in digital currencies among financial professionals is reshaping how investment strategies are formulated. As more registered investment advisers (RIAs) evaluate the potential of crypto assets, the need for comprehensive understanding and communication about these products becomes paramount. With the introduction of crypto ETFs, these financial planners are increasingly urged to consider including cryptocurrencies in their offerings. The shift towards embracing these alternative assets is driven by client demand, prompting advisers to rethink their traditional approaches. As the landscape of wealth management evolves, the integration of cryptocurrencies into financial planning represents a significant opportunity for both advisers and investors alike.

The Role of Financial Advisers in Crypto Adoption

Financial advisers play a crucial role in the adoption of cryptocurrencies among everyday investors. They serve as trusted intermediaries, guiding clients through investment decisions and helping them navigate the complexities of emerging asset classes like crypto. With the introduction of crypto ETFs, advisers are now in a position to recommend these products as part of diversified investment strategies. This shift could significantly broaden the reach of cryptocurrencies beyond the niche market of dedicated crypto investors, enabling a wider demographic to participate in this asset class.

Despite the potential benefits, many financial advisers remain skeptical about integrating cryptocurrencies into their clients’ portfolios. A significant portion, over 55%, express no intention of discussing crypto investments with their clients. This hesitance is often rooted in concerns over market volatility and regulatory uncertainties. To successfully win over financial advisers, the crypto industry must address these concerns by providing comprehensive educational resources, demonstrating market stability, and clarifying regulatory frameworks surrounding these digital assets.

Understanding Crypto ETFs and Their Impact

Crypto ETFs represent a transformative development in the investment landscape, providing a more accessible way for investors to gain exposure to cryptocurrencies. These funds, which have gained traction since their launch, allow financial advisers to integrate crypto into client portfolios without the complexities of direct ownership. The ability to invest in products like Bitcoin and Ether ETFs can help alleviate the concerns many advisers have regarding volatility and security, making it easier for them to recommend these assets as part of a balanced investment strategy.

The impact of crypto ETFs on the adoption of cryptocurrencies cannot be overstated. As RIAs and other financial advisers begin to explore these products, they are likely to find that their clients are increasingly interested in diversifying their investments with digital assets. This growing demand is evident, with approximately 25% of RIAs currently exploring crypto options due to client inquiries. As more advisers become comfortable with these funds and their benefits, we can expect to see a significant uptick in the adoption of cryptocurrencies among traditional investors.

Challenges Facing RIAs in Embracing Crypto

While the momentum for crypto adoption is gaining, registered investment advisers (RIAs) face several challenges that hinder their full embrace of cryptocurrencies. One significant barrier is the fear of volatility in crypto markets, which makes many advisers cautious about recommending these investments to clients. Additionally, a lack of regulatory clarity around crypto assets poses another challenge, leaving advisers uncertain about compliance and best practices in managing these investments.

To overcome these challenges, RIAs need to be proactive in their education and understanding of the crypto landscape. Engaging with industry experts, attending workshops, and staying informed about regulatory developments can help advisers build the confidence required to incorporate cryptocurrencies into their investment strategies. As the market matures and becomes more stable, it is likely that advisers will begin to see the potential rewards of including crypto in their clients’ portfolios.

The Growing Interest in Cryptocurrencies Among RIAs

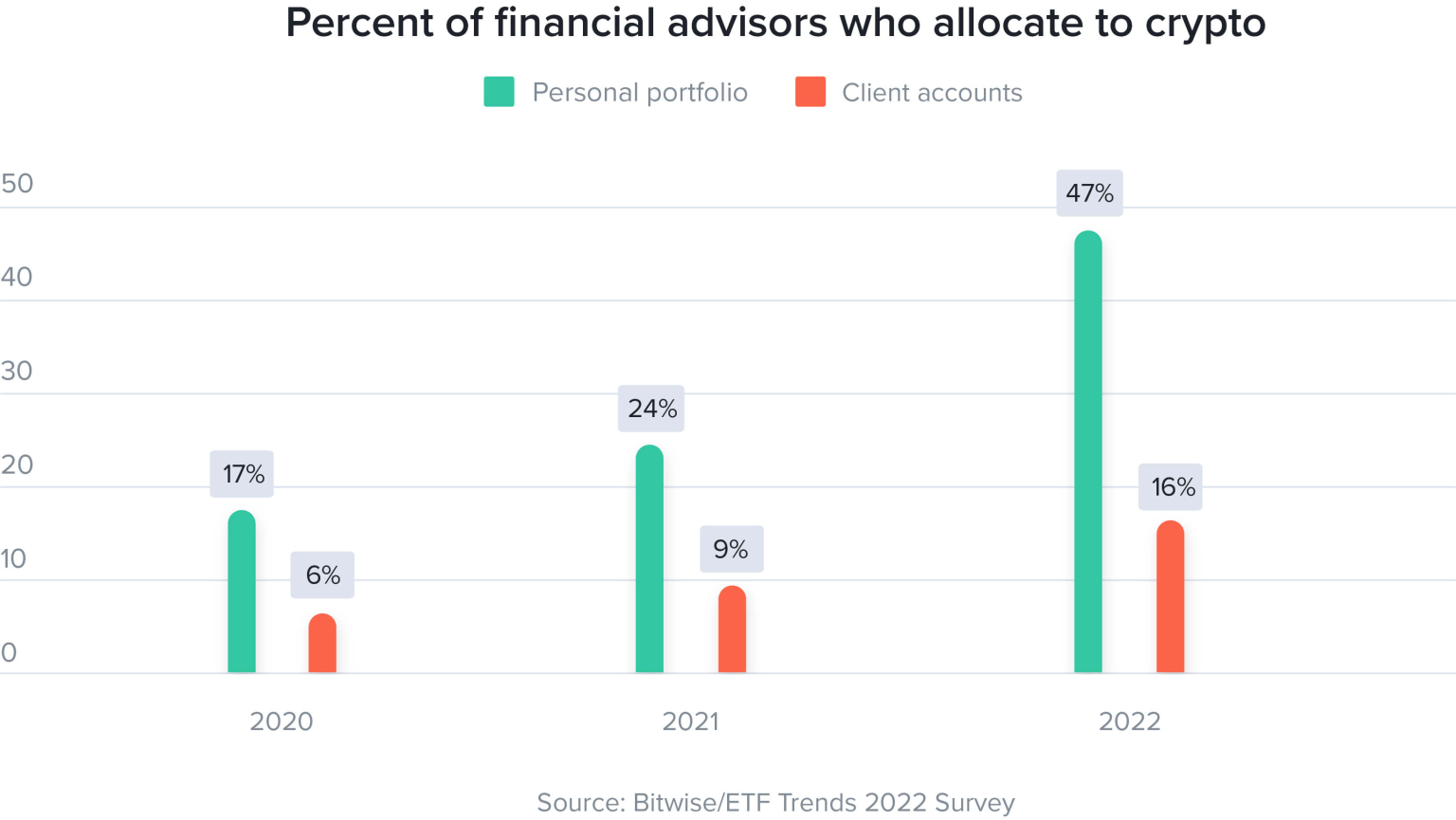

Despite the existing skepticism, interest in cryptocurrencies is beginning to take root among financial advisers. Recent surveys indicate that nearly 18% of RIAs plan to explore crypto investments soon, driven largely by client demand. This shift in perspective highlights a growing acknowledgment of the potential for cryptocurrencies to enhance investment strategies and diversify client portfolios. As more advisers engage in discussions about crypto, they are likely to discover innovative ways to incorporate these assets into their investment offerings.

Moreover, the increasing acceptance of crypto ETFs among RIAs further underscores this trend. With products like iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund gaining traction, more advisers are finding it easier to recommend cryptocurrencies to their clients. This growing acceptance can lead to a significant transformation in how RIAs view and utilize digital assets in their practices, ultimately driving wider adoption of cryptocurrencies across the financial advising landscape.

Educational Resources: Bridging the Knowledge Gap

One of the most pressing needs in the financial advisory industry concerning crypto adoption is the availability of educational resources. Many advisers lack a comprehensive understanding of cryptocurrencies, which can hinder their ability to engage with clients on the topic. Providing targeted educational materials, training sessions, and workshops focusing on crypto ETFs and their implications for investment strategies can help bridge this knowledge gap and empower advisers to make informed recommendations.

By investing in education and fostering a culture of learning about digital assets, RIAs can better position themselves to meet the evolving needs of their clients. As more clients express interest in cryptocurrencies, advisers who are well-versed in the subject matter will be better equipped to provide sound advice and facilitate responsible investment in these emerging assets. This proactive approach to education can significantly enhance the overall adoption of cryptocurrencies among traditional investors.

Regulatory Considerations for Advisers

Regulatory clarity is essential for financial advisers considering the inclusion of cryptocurrencies in their investment strategies. As the market evolves, regulations surrounding crypto assets are also developing, creating a complex landscape for advisers to navigate. Understanding current regulations and anticipating future changes can help RIAs mitigate risks and confidently recommend crypto products to their clients.

Furthermore, advisers should stay actively engaged with regulatory developments, participating in discussions and advocating for clearer guidelines in the industry. By being informed and involved, financial advisers can not only protect their clients but also contribute to shaping a more transparent and trustworthy environment for cryptocurrency investments. This engagement is vital for building the credibility and legitimacy of cryptocurrencies in the eyes of both advisers and their clients.

The Impact of Market Volatility on Crypto Adoption

Market volatility remains one of the primary concerns for financial advisers when it comes to recommending cryptocurrencies. The significant price fluctuations associated with digital assets can be alarming for both advisers and their clients, leading to hesitance in adopting these investments. Understanding the factors that contribute to crypto market volatility can help advisers assess the risks and communicate them effectively to their clients, allowing for more informed decision-making.

However, it is essential to note that volatility can also present opportunities for savvy investors. As advisers become more familiar with crypto markets and their dynamics, they may find ways to capitalize on these fluctuations while managing risk effectively. By employing robust risk management strategies and educating clients about the potential for both gains and losses, advisers can foster a more balanced view of cryptocurrencies as a viable investment option.

Future of Crypto in Investment Strategies

The future of cryptocurrencies in investment strategies looks promising as more financial advisers recognize the value these assets can bring to diversified portfolios. With the launch of crypto ETFs and increasing client interest, advisers who embrace this trend may find themselves at the forefront of a significant shift in the investment landscape. As crypto becomes more integrated into traditional investment strategies, it is likely to attract a broader range of investors seeking exposure to this innovative asset class.

As the market matures and more educational resources become available, financial advisers will be better equipped to navigate the complexities of cryptocurrencies. This will enable them to develop tailored investment strategies that meet their clients’ unique goals and risk tolerances. Ultimately, the successful integration of cryptocurrencies into mainstream investment strategies will hinge on the collaboration between advisers, clients, and the evolving regulatory framework surrounding digital assets.

Strategies for Engaging Clients on Crypto Investments

Engaging clients on crypto investments requires a thoughtful approach that balances education, transparency, and tailored advice. Financial advisers should initiate conversations with their clients about cryptocurrencies by gauging their interest and understanding of the subject. This dialogue can help advisers identify clients who are ready to explore crypto investments while addressing any concerns or misconceptions they may have.

Additionally, providing clients with resources that explain the fundamentals of cryptocurrencies, the benefits of crypto ETFs, and the associated risks can empower them to make informed decisions. By fostering an open and supportive environment for discussing digital assets, advisers can build trust and facilitate a smoother transition for clients interested in incorporating crypto into their portfolios.

| Key Point | Details |

|---|---|

| Current State of Crypto Adoption | Crypto is struggling to expand beyond its core investor base, despite high valuations and the introduction of ETFs. |

| Role of Financial Advisers | Registered Investment Advisers (RIAs) are crucial for broader crypto adoption, managing everyday investors’ portfolios. |

| ETF Market Potential | The ETF market in the US is valued at $9 trillion, with RIAs potentially driving 30-50% of flows. |

| Skepticism Among RIAs | Over 55% of RIAs do not plan to discuss or use cryptocurrency investments. |

| Interest in Crypto Growing | With increasing client requests, around 25% of RIAs are exploring crypto investments. |

| Regulatory Challenges | Regulatory ambiguity and market volatility are significant barriers to crypto adoption among RIAs. |

| Emerging Trends | The launch of Bitcoin and Ether ETFs is changing attitudes toward crypto investments among advisers. |

Summary

Crypto adoption by financial advisers is on the verge of a significant transformation, driven by client demand and the recent launch of ETFs. As the landscape evolves, financial advisers are beginning to recognize the potential of cryptocurrencies, particularly Bitcoin and Ethereum, as viable investment options. However, overcoming skepticism and regulatory hurdles remains crucial for widespread acceptance. The future of crypto investment is bright, but its success hinges on building trust and demonstrating stability in this dynamic market.