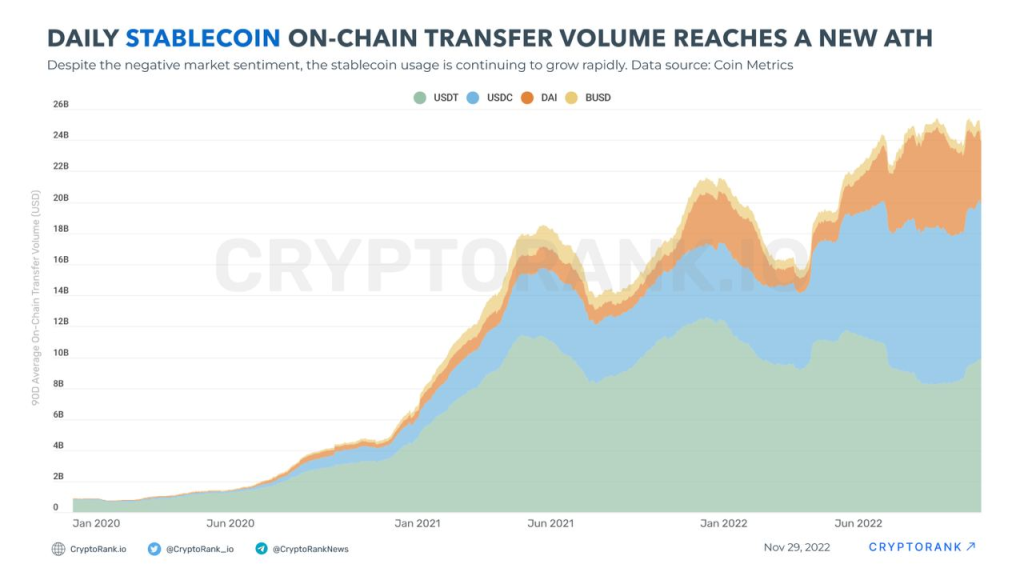

In the rapidly evolving landscape of cryptocurrency, stablecoin transfer volumes have emerged as a pivotal metric, surpassing the combined transaction totals of Visa and Mastercard in 2024. With an astounding annual transfer volume of $27.6 trillion, stablecoins have solidified their role as the backbone of crypto trading and decentralized finance (DeFi). This surge in stablecoin adoption indicates a growing reliance on these digital assets amid shifting crypto market trends. Notably, Tether USDt has maintained its dominance, accounting for nearly 80% of stablecoin trading volumes, reflecting its significance in the ecosystem. As we move into 2024, understanding the factors driving stablecoin transfer volumes will be crucial for navigating the future of decentralized finance and cryptocurrency investments.

As we delve into the world of digital currencies, the soaring transfer volumes of stablecoins represent a fundamental shift in financial transactions. These digital tokens, designed to maintain a stable value, have become instrumental in the realm of crypto trading and decentralized finance. The dramatic rise in their utilization showcases a growing trend towards using stable assets for various purposes, from trading to remittances. Furthermore, the dominance of Tether USDt highlights its critical role within this financial revolution. Exploring these alternative forms of currency reveals the intricate dynamics that are reshaping the crypto landscape.

The Rise of Stablecoin Transfer Volumes in 2024

In 2024, stablecoin transfer volumes soared to unprecedented heights, eclipsing the combined transaction figures of Visa and Mastercard. This remarkable achievement highlights the growing acceptance and reliance on stablecoins within the global financial ecosystem. With a staggering annual transfer volume of $27.6 trillion, stablecoins have cemented their position as a pivotal component of the cryptocurrency landscape, particularly in the realms of crypto trading and decentralized finance (DeFi). As traditional financial institutions grapple with digital transformation, stablecoins present a compelling alternative that caters to the demands of modern users.

The surge in stablecoin transfer volumes can be attributed to several factors, including the rise of automated trading bots and an increasing number of users opting for stablecoins over conventional currencies for their transactions. As reported by CEX.io, bots accounted for a significant portion of these transactions, particularly on blockchain platforms like Solana and Base. The integration of such technology not only enhances transaction efficiency but also broadens the accessibility and usability of stablecoins in various financial applications.

| Key Point | Details |

|---|---|

| Stablecoin Transfer Volumes | In 2024, stablecoin transfer volumes reached $27.6 trillion, surpassing the combined totals of Visa and Mastercard by 7.7%. |

| Market Share | Despite high volumes, stablecoins experienced a 13.5% decline in overall market share, with the supply increasing by 59%. |

| Role of Bots | Bots accounted for 70% of stablecoin transfer volumes, with significant activity on platforms like Solana and Base. |

| Dominant Networks | Ethereum and Tron held over 83% of the market share for stablecoins, although Tron saw a notable decline from 38% to 29%. |

| Future Trends | More users are turning to stablecoins for savings and remittances, as they offer cost-effective alternatives to traditional methods. |

Summary

Stablecoin transfer volumes have significantly transformed the landscape of digital payments and finance. In 2024, the annual stablecoin transfer volume reached an impressive $27.6 trillion, surpassing that of both Visa and Mastercard combined. This remarkable growth highlights the increasing reliance on stablecoins as a pivotal element in cryptocurrency trading and decentralized finance (DeFi), despite a slight decline in market share. The substantial activity from trading bots on networks like Solana and Ethereum has further propelled stablecoin usage, making them an attractive option for everyday transactions. As the market continues to evolve, stablecoins are likely to play an even more critical role in the financial ecosystem.