As Bitcoin taxes become increasingly relevant in today’s digital economy, investors must grasp the intricate rules surrounding cryptocurrency taxation. Understanding Bitcoin tax compliance is crucial, as the IRS treats cryptocurrencies as property, leading to capital gains taxes on transactions. Investors should be aware that selling, trading, or even mining Bitcoin can trigger tax obligations, making tax reporting for Bitcoin essential to avoid penalties. Inaccurate reporting can result in significant consequences, including tax fraud accusations, which the IRS is keen to investigate. By staying informed about IRS Bitcoin rules and implementing effective strategies, investors can navigate the complexities of their tax responsibilities with greater confidence.

When it comes to the taxation of digital currencies, many investors find themselves confronted with the nuances of cryptocurrency tax regulations. The financial landscape is evolving, and the implications of Bitcoin taxation are a critical area of concern for crypto enthusiasts. Investors must stay attuned to the legal frameworks governing their assets, especially regarding capital gains and income derived from their Bitcoin activities. Understanding the distinctions between taxable and non-taxable transactions is vital for maintaining compliance and avoiding unintended legal issues. As the IRS continues to refine its approach to cryptocurrency taxation, being proactive in tax reporting for Bitcoin is essential for all investors.

Understanding Bitcoin Taxes and Your Obligations

In the realm of cryptocurrency taxation, Bitcoin taxes are a critical area for investors to grasp. As cryptocurrencies are classified as property by the IRS, this classification leads to capital gains taxes being applied to any profits made through the selling or trading of Bitcoin. Investors must be aware that every transaction, whether it’s selling Bitcoin for fiat currency or exchanging it for another cryptocurrency, can lead to tax implications. Therefore, understanding the tax obligations associated with these activities is essential to avoid potential legal issues.

Moreover, Bitcoin tax compliance isn’t just about knowing when to pay taxes; it’s also about accurately reporting all transactions. Investors should maintain detailed records and keep track of the cost basis for each Bitcoin transaction, as failure to do so could result in significant penalties. Given the IRS’s increasing scrutiny over cryptocurrency transactions, having a clear understanding of Bitcoin taxes and adhering to best practices in tax reporting for Bitcoin can safeguard investors from unnecessary complications.

Taxable vs. Non-Taxable Transactions in Bitcoin

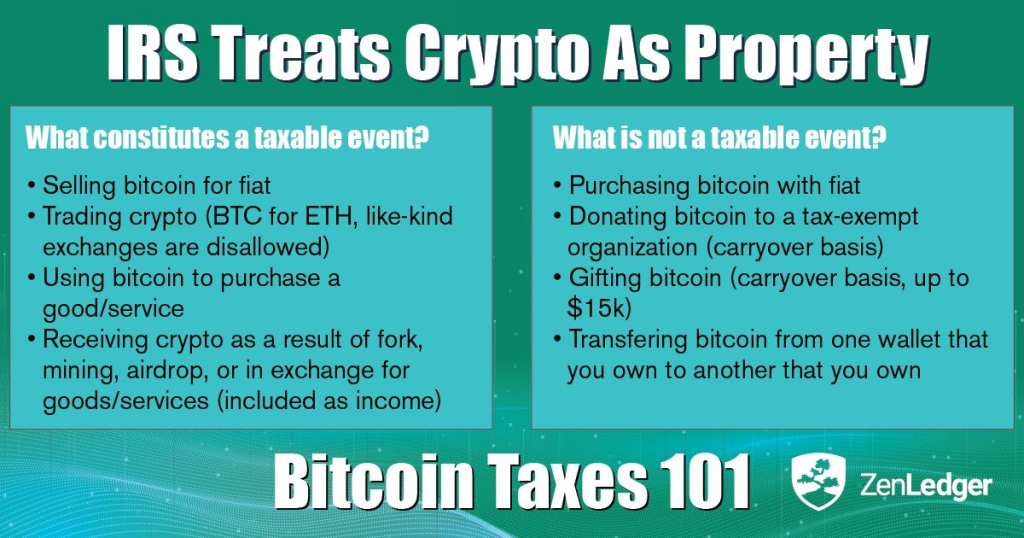

Understanding the difference between taxable and non-taxable transactions is crucial for Bitcoin investors. Taxable transactions include selling Bitcoin for fiat currency, trading between cryptocurrencies, and using Bitcoin to purchase goods or services. Each of these actions represents a sale, and as such, they require investors to report any gains or losses for tax purposes. Failing to account for these transactions can lead to issues with the IRS, including potential audits or penalties, making it imperative for investors to recognize these taxable events.

On the other hand, non-taxable transactions provide a safe harbor for Bitcoin investors. Activities such as buying Bitcoin with fiat currency, transferring Bitcoin between personal wallets, or gifting Bitcoin under certain limits do not incur tax liabilities. This distinction can significantly impact an investor’s overall tax strategy. By understanding what constitutes a non-taxable transaction, investors can make informed decisions that optimize their tax obligations while complying with cryptocurrency taxation laws.

Navigating IRS Bitcoin Rules for Compliance

The IRS has established specific rules regarding Bitcoin taxation, which can be complex and often daunting for many investors. One of the key aspects of IRS Bitcoin rules is the requirement for investors to report all cryptocurrency transactions accurately. This includes not only sales and trades but also the receipt of Bitcoin as income or from mining activities. Investors must familiarize themselves with tax reporting forms and the necessary documentation to ensure they meet compliance requirements.

Additionally, the IRS has mechanisms in place to track Bitcoin transactions, including blockchain analysis and cooperation with cryptocurrency exchanges. This means that investors who attempt to evade taxes or misreport their transactions may face severe repercussions. By staying informed about IRS Bitcoin rules and adhering to proper tax reporting practices, investors can mitigate the risk of audits or penalties while ensuring that they remain compliant with the law.

Common Mistakes to Avoid in Bitcoin Tax Reporting

When it comes to Bitcoin tax reporting, there are several common mistakes that investors should be wary of. One prevalent error is failing to track the cost basis accurately. Without a clear record of the purchase price, realizing gains or losses becomes complicated, leading to incorrect tax filings. Additionally, many investors neglect to report crypto-to-crypto trades, which are treated as taxable events by the IRS. Ignoring these trades can result in significant tax liabilities, making it crucial to account for every transaction.

Another mistake often made by Bitcoin investors involves overlooking income generated from mining or staking rewards. This income is subject to taxation and must be reported accordingly. By understanding these common pitfalls and implementing a robust tracking system, investors can enhance their Bitcoin tax compliance and avoid the costly repercussions of misreporting.

Strategies for Optimizing Bitcoin Taxes Legally

Optimizing Bitcoin taxes legally involves leveraging various strategies that can reduce taxable income and capital gains. Tax-loss harvesting is one effective method where investors can offset gains by selling underperforming Bitcoin assets. This strategy not only minimizes tax liabilities but also allows investors to rebalance their portfolios strategically.

Additionally, gifting Bitcoin can be a smart approach to mitigate taxes, provided the gifts remain within the annual exclusion limits set by the IRS. Long-term holding of Bitcoin can also result in lower tax rates, as long-term capital gains typically incur a reduced tax compared to short-term gains. Furthermore, donating appreciated Bitcoin directly to qualified charities can provide significant tax benefits while supporting philanthropic causes.

The Importance of Accurate Record Keeping in Bitcoin Taxes

Accurate record keeping is paramount for Bitcoin investors aiming to navigate the intricate landscape of cryptocurrency taxation. Maintaining comprehensive records of all transactions, including dates, amounts, and the purpose of each transaction, is essential for effective tax reporting. This diligence not only simplifies the filing process but also provides necessary documentation in case of an IRS audit.

Investors should consider utilizing cryptocurrency tax software to streamline the record-keeping process. These tools can automatically track transactions across various exchanges and wallets, generating the necessary reports for tax compliance. By adopting robust record-keeping practices, Bitcoin investors can ensure they meet their tax obligations while minimizing the risk of errors that could lead to audits or penalties.

Staying Updated on Bitcoin Tax Regulations

As cryptocurrency taxation evolves, staying updated on Bitcoin tax regulations is crucial for investors. The tax landscape is subject to frequent changes, and regulators are continuously refining their approaches to cryptocurrency. By being proactive and monitoring updates from the IRS and other regulatory bodies, investors can adapt their strategies to remain compliant and take advantage of any new tax benefits that may arise.

Additionally, participating in online forums, attending cryptocurrency meetups, and following reputable sources can provide valuable insights into the latest developments in Bitcoin tax regulations. Seeking professional tax advice is also recommended, as tax professionals can offer tailored guidance based on individual circumstances, ensuring that investors are well-informed and compliant with the ever-changing rules surrounding Bitcoin taxes.

The Role of Cryptocurrency Tax Software

Cryptocurrency tax software plays a vital role in simplifying the tax reporting process for Bitcoin investors. These tools are designed to automatically track transactions across multiple exchanges and wallets, providing users with real-time data on gains and losses. This automated solution significantly reduces the risk of human error, which can lead to inaccuracies in tax filings.

Furthermore, many cryptocurrency tax software options are equipped with features that help generate the necessary tax forms required for reporting to the IRS. By utilizing these tools, investors can ensure they remain compliant with Bitcoin tax regulations while saving time and effort during the tax season. In an increasingly complex tax environment, leveraging technology can be a game-changer for effective Bitcoin tax compliance.

Consequences of Non-Compliance in Bitcoin Taxes

The consequences of non-compliance with Bitcoin taxes can be severe, ranging from financial penalties to criminal charges in extreme cases. The IRS actively pursues individuals who attempt to evade taxes through illegal means, such as underreporting income or failing to report capital gains from Bitcoin transactions. This can lead to significant fines, interest on unpaid taxes, and, in serious cases, jail time.

Additionally, the reputational damage that comes with tax evasion can have long-lasting effects on an individual’s financial standing and business prospects. Therefore, it is essential for Bitcoin investors to prioritize tax compliance, understand their obligations, and implement best practices in tax reporting to avoid the dire consequences of non-compliance.

Frequently Asked Questions

What are the key aspects of Bitcoin taxes that investors should know?

Bitcoin taxes primarily involve understanding that selling, trading, and mining Bitcoin are taxable events. Investors must accurately report these transactions to comply with IRS Bitcoin rules. Non-taxable activities include buying Bitcoin with fiat currency and transferring between wallets.

How do capital gains taxes apply to Bitcoin investments?

Capital gains taxes on Bitcoin apply when the cryptocurrency is sold at a profit. The taxable amount is the difference between the purchase price and the sale price. Investors should be aware of short-term vs. long-term gains, as longer holdings may qualify for lower tax rates.

What constitutes taxable transactions in Bitcoin taxation?

Taxable transactions in Bitcoin taxation include selling Bitcoin for fiat, trading Bitcoin for another cryptocurrency, using Bitcoin to purchase goods or services, receiving Bitcoin as income, and mining Bitcoin. Each of these actions triggers tax reporting requirements.

Are there any non-taxable Bitcoin transactions?

Yes, non-taxable Bitcoin transactions include buying Bitcoin with fiat currency, transferring Bitcoin between wallets, and gifting Bitcoin under specific limits. These actions do not trigger tax implications immediately.

How should investors report Bitcoin for tax compliance?

Investors should report Bitcoin for tax purposes by maintaining detailed records of all transactions, including dates and amounts. Accurate reporting typically involves specific tax forms that summarize capital gains and losses related to Bitcoin transactions.

What are common mistakes investors make regarding Bitcoin tax compliance?

Common mistakes include not accurately tracking the cost basis of Bitcoin, failing to report crypto-to-crypto trades, and ignoring income from mining or staking rewards. These errors can lead to penalties during tax assessments.

How does the IRS track Bitcoin transactions for tax compliance?

The IRS tracks Bitcoin transactions using various methods, including subpoenaing exchange data, analyzing blockchain records, and cooperating with international tax authorities. This tracking helps identify potential tax fraud.

What are legal strategies to optimize Bitcoin taxes?

Legal strategies to optimize Bitcoin taxes include tax-loss harvesting to offset gains, gifting Bitcoin under exemption limits, holding Bitcoin long-term for reduced rates, and donating appreciated crypto directly to charities to minimize tax liabilities.

What can happen if an investor commits Bitcoin tax fraud?

Committing Bitcoin tax fraud can lead to severe consequences, including penalties, interest on unpaid taxes, and potential criminal charges for significant tax evasion cases. The IRS actively pursues tax fraud through its tracking methods.

What should Bitcoin investors do to ensure tax compliance?

Bitcoin investors should maintain detailed records of all transactions, utilize cryptocurrency tax software to streamline reporting, stay informed about changes in cryptocurrency taxation laws, and consult with professional tax advisors for personalized guidance.

| Key Points | Details |

|---|---|

| Taxable Activities | Selling, trading, and mining Bitcoin are taxable. |

| Non-Taxable Activities | Buying Bitcoin with fiat, transferring between wallets, and gifting within limits. |

| Capital Gains Tax | Taxes are due on profits from selling Bitcoin. |

| Short-Term vs. Long-Term Gains | Holding period impacts tax rates. |

| Tax Reporting | Accurate reporting of transactions is crucial to avoid penalties. |

| Common Mistakes | Not tracking cost basis, failing to report trades, ignoring mining income. |

| Tax Compliance Tips | Maintain records, use tax software, stay updated on regulations. |

Summary

Bitcoin taxes are an essential aspect for investors to understand in order to avoid legal complications. As cryptocurrencies like Bitcoin are treated as property by the IRS, all taxable transactions must be reported accurately, including sales and exchanges. By knowing the difference between taxable and non-taxable activities and implementing effective tax strategies, investors can mitigate their tax liabilities and ensure compliance with legal obligations.