Bitcoin price risks are increasingly capturing the attention of investors as the cryptocurrency market experiences fluctuating trends. While Bitcoin has shown year-to-date gains of around 10%, its performance pales in comparison to gold, which has surged by 20% in the same period. This discrepancy highlights the complex relationship between Bitcoin and gold, especially in times of macroeconomic uncertainty. As gold continues to defy the strength of the US dollar and S&P 500 volatility, Bitcoin analysts are raising concerns about potential price corrections. Understanding these Bitcoin price risks is crucial for investors looking to navigate the ever-changing landscape of cryptocurrency market trends.

The financial landscape is rife with uncertainties, particularly regarding the potential hazards associated with Bitcoin’s valuation. As digital assets face headwinds, the comparative analysis with traditional macro assets like gold becomes indispensable. Investors are keenly observing the year-to-date performance of these assets, especially as gold’s resilience contrasts sharply with Bitcoin’s more volatile price movements. The intricate dynamics within the Bitcoin and gold relationship provide insight into broader market trends, revealing the possible implications of recent market shifts. Recognizing the underlying risks tied to Bitcoin’s price fluctuations is essential for informed investment decisions.

Understanding Bitcoin Price Risks in the Current Market

In the ever-evolving landscape of cryptocurrency, Bitcoin price risks are becoming increasingly prominent, especially in the context of its relationship with traditional assets like gold. While Bitcoin has experienced a modest 10% gain year-to-date, gold has outshined it with a remarkable 20% increase. This disparity raises concerns among investors about the sustainability of Bitcoin’s performance, particularly as macroeconomic factors continue to influence market dynamics. The volatility in the cryptocurrency market, coupled with Bitcoin’s current limbo, creates a perfect storm for potential price corrections.

Investors should be aware that the price risks associated with Bitcoin may stem from several factors, including regulatory changes, market sentiment shifts, and technological developments. For instance, the recent fluctuations in gold prices, which have notably defied the strength of the US dollar, may indicate a forthcoming shift in investor preferences. If Bitcoin is unable to establish a strong upward trend, it risks falling into a bear market, mirroring gold’s historical price movements during periods of economic uncertainty.

The Relationship Between Bitcoin and Gold Prices

The relationship between Bitcoin and gold is a fascinating topic, particularly as both assets are viewed as hedges against inflation and economic instability. As Bitcoin continues to establish itself as a digital store of value, many investors are closely monitoring its correlation with gold. The recent performance of gold suggests that it remains a favorable option for risk-averse investors, especially during turbulent market conditions. This trend raises the question of whether Bitcoin can maintain its appeal or if it will succumb to the same pressures that affect traditional assets.

Furthermore, the historical inverse correlation of gold prices to the US dollar adds another layer of complexity to the Bitcoin and gold relationship. As gold prices surge despite the dollar’s strength, Bitcoin’s ability to attract investors may be compromised. If Bitcoin fails to gain traction and continues to lag behind gold, it may struggle to break free from the price risks that threaten its long-term viability. Investors should consider these dynamics when evaluating the potential for Bitcoin to rise alongside gold in the coming months.

Analyzing Year-to-Date Gains of Bitcoin vs. Gold

When comparing the year-to-date gains of Bitcoin and gold, it becomes clear that gold has outperformed Bitcoin significantly. With a 20% increase, gold has proven its resilience against market volatility, while Bitcoin’s 10% gain raises concerns among investors. The cryptocurrency market trends suggest that Bitcoin may be at a crossroads, needing a decisive rebound to maintain its upward trajectory. As investors analyze their portfolios, understanding these gains is crucial for making informed decisions.

The stark difference in performance can be attributed to various macroeconomic factors and market trends. As global economic conditions fluctuate, investors may lean towards gold as a safer asset during uncertain times. Bitcoin, on the other hand, must find its footing and establish a narrative that resonates with investors. The continuing divergence in performance between these two assets will be a key indicator of future trends in both the cryptocurrency and macro asset markets.

Macro Assets and Their Impact on Bitcoin’s Performance

Macro assets play a significant role in shaping the performance of cryptocurrencies like Bitcoin. As traditional financial markets react to changes in economic indicators, the implications for Bitcoin can be profound. For instance, as gold continues to rise despite external shocks, Bitcoin’s price risks become more apparent. Investors are increasingly turning to macro assets to gauge the health of the cryptocurrency market, making it essential for Bitcoin to align itself with broader market trends.

Additionally, the behavior of other macro assets, such as commodities and equities, can influence Bitcoin’s price movements. The current market scenario, where gold is thriving while Bitcoin remains stagnant, highlights the importance of understanding these correlations. If Bitcoin can successfully navigate the challenges posed by macroeconomic conditions, it may reclaim its status as a leading asset in the financial landscape. However, continued monitoring of macro trends is crucial for investors looking to mitigate Bitcoin price risks.

Cryptocurrency Market Trends Influencing Bitcoin Prices

The cryptocurrency market is subject to rapid changes, influenced by a variety of factors ranging from regulatory developments to technological advancements. Current trends suggest a cautious approach among investors, particularly regarding Bitcoin, which has shown a lack of directional catalysts in recent weeks. This uncertainty can lead to increased price risks, as traders become more hesitant to commit to positions. Understanding cryptocurrency market trends is vital for investors looking to capitalize on potential price movements.

Moreover, as Bitcoin grapples with its identity within the broader financial ecosystem, it faces competition from other cryptocurrencies that are gaining traction. The rise of altcoins and their unique value propositions may further complicate Bitcoin’s market position. To counteract the risks associated with stagnation, Bitcoin must adapt to changing market trends and continue to appeal to investors seeking growth opportunities. Staying abreast of cryptocurrency market trends will be essential for those looking to navigate the complexities of Bitcoin’s performance.

Investment Strategies in Light of Bitcoin Price Risks

Given the current landscape of Bitcoin price risks, it is crucial for investors to adopt sound investment strategies. Diversification remains a key strategy, allowing investors to spread their risk across various assets, including gold and other cryptocurrencies. By not putting all their eggs in one basket, investors can mitigate potential losses associated with Bitcoin’s volatility. Understanding the interplay between Bitcoin and gold can also inform investment choices, as these assets often react differently to macroeconomic changes.

In addition to diversification, investors should consider employing a disciplined approach to trading and investment. This involves setting clear entry and exit points, as well as utilizing stop-loss orders to protect against significant downturns. By maintaining a strategic mindset, investors can better navigate the inherent risks associated with Bitcoin and the cryptocurrency market. Ultimately, staying informed and adaptable will be key in responding to the evolving landscape of Bitcoin price risks.

The Future of Bitcoin Amidst Gold’s Resurgence

As gold continues to demonstrate resilience against economic pressures, the future of Bitcoin remains uncertain. Analysts are keenly observing how Bitcoin will respond to gold’s resurgence, especially as concerns about price risks mount. The cryptocurrency may need to establish a stronger narrative to attract investors who are currently gravitating towards gold as a safe haven. If Bitcoin fails to adapt and innovate, it risks being sidelined in favor of traditional assets like gold.

However, the future is not entirely bleak for Bitcoin. The growing acceptance of cryptocurrencies in mainstream finance suggests that there is still potential for growth. Innovations in blockchain technology and increasing institutional interest may provide the necessary support for Bitcoin to reclaim its position as a leading asset. Moving forward, the interplay between Bitcoin and gold will be critical in determining Bitcoin’s trajectory and its ability to mitigate price risks.

Evaluating the Role of Institutional Investors in Bitcoin’s Stability

Institutional investors have become increasingly influential in the cryptocurrency market, particularly regarding Bitcoin’s stability. As large financial entities enter the market, their investment strategies and risk management approaches can significantly impact Bitcoin’s price dynamics. Institutional interest in Bitcoin may help to stabilize its price, as these investors often bring a level of sophistication and long-term perspective that can mitigate volatility. Understanding the role of institutional investors is essential for assessing Bitcoin’s future performance.

However, the involvement of institutional investors also comes with its challenges. Their presence may create a disconnect between retail and institutional pricing, leading to increased volatility during market corrections. Moreover, institutional investors often prioritize risk-adjusted returns, which may shift their focus away from Bitcoin if price risks escalate. Therefore, monitoring the actions of institutional investors will be crucial for predicting Bitcoin’s stability and its potential to navigate the challenges posed by the broader financial landscape.

Risk Management Techniques for Bitcoin Investors

Effective risk management is paramount for investors navigating the potentially volatile waters of Bitcoin. Utilizing techniques such as position sizing, stop-loss orders, and continuous portfolio rebalancing can help mitigate the inherent risks associated with cryptocurrency investments. By employing these strategies, investors can protect their capital and reduce the likelihood of significant losses resulting from sudden market shifts or adverse price movements.

Additionally, education plays a vital role in risk management for Bitcoin investors. Staying informed about market trends, regulatory developments, and technological advancements can empower investors to make well-informed decisions. Engaging with educational resources, attending webinars, and following market analysts can provide valuable insights into the evolving landscape of Bitcoin. Ultimately, a proactive approach to risk management can help investors navigate the complexities of Bitcoin price risks and enhance their overall investment experience.

| Key Point | Details |

|---|---|

| Bitcoin Price Performance | Bitcoin (BTC) has gained 10% year-to-date. |

| Gold’s Performance | Gold (XAU) has risen 20% in 2024 and has outperformed the S&P 500. |

| Market Conditions | Gold has maintained its value despite US dollar strength and market volatility. |

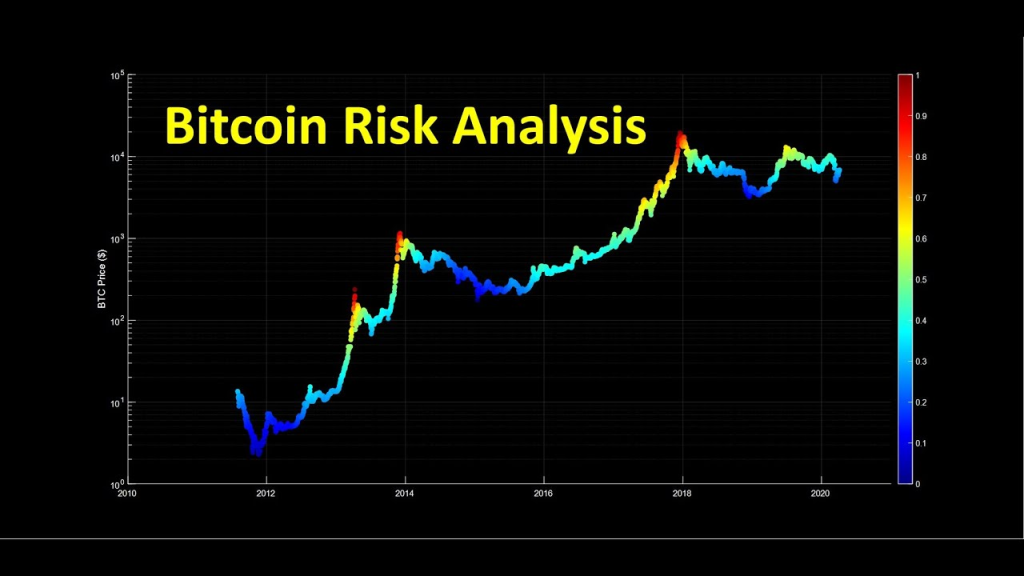

| Bitcoin and Gold Correlation | Bitcoin is theorized to lag behind gold’s price movements. |

| Critical Price Levels | A critical level for Bitcoin is suggested to be at a ratio above 34 to maintain bullish momentum. |

| Investment Disclaimer | Investing in Bitcoin involves risks, and individual research is necessary. |

Summary

Bitcoin price risks are currently heightened as the cryptocurrency finds itself in a precarious situation following significant gains. Despite a year-to-date increase of 10%, Bitcoin is closely watched due to its potential correlation with gold, which has shown robust performance against the backdrop of US dollar strength. The critical levels indicated by analysts suggest that a failure to maintain a certain price ratio could undermine Bitcoin’s bullish trajectory. Investors should remain cautious and conduct thorough research before making any investment decisions.