Bitcoin price has been a hot topic in the cryptocurrency world, especially after it recently bounced back above the critical $100,000 mark. The latest data shows BTC/USD gaining approximately 4.6% from local lows of $97,750, demonstrating resilience amidst market volatility. This bounce comes on the heels of a sharp decline in US equities, triggered by concerns surrounding the competitive landscape following the launch of China’s ChatGPT competitor, DeepSeek. Traders are now closely analyzing Bitcoin price prediction trends, with many focusing on key support levels to gauge the market’s direction. As cryptocurrency trends evolve, understanding Bitcoin’s price movements becomes crucial for anyone involved in BTC trading.

The value of Bitcoin has recently captured the attention of investors and analysts alike, particularly with its notable recovery above the $100,000 threshold. As the cryptocurrency landscape shifts, discussions surrounding BTC’s market dynamics, such as its price forecasts and the implications of recent fluctuations, have intensified. The recent uptick in Bitcoin’s value not only highlights its potential resilience but also raises questions about the broader cryptocurrency market analysis. With various support levels being tested, market participants are keenly observing how these factors influence overall trading strategies. Engaging with these developments is essential for those looking to navigate the ever-evolving world of digital assets.

Bitcoin Price Analysis: A Strong Bounce Back

The recent surge in Bitcoin price signals a noteworthy recovery, as BTC managed to bounce back by approximately 5%, lifting its value above the critical $100,000 mark. This positive shift in the cryptocurrency market can be attributed to a combination of factors, particularly the resilience displayed by Bitcoin amidst a broader sell-off in U.S. equities. The ability of Bitcoin to rebound from a local low of $97,750 suggests that trader sentiment remains cautiously optimistic, especially in light of potential market overreactions to external economic pressures.

Analysts are now focusing on key support levels, with many suggesting that maintaining above $95,000 could pave the way for further gains. A firm footing at these levels would not only bolster bullish sentiments among traders but also indicate a potential for Bitcoin to continue its upward trajectory over the coming weeks. As we delve deeper into market analysis, it’s crucial to monitor how Bitcoin interacts with these support levels, as they will play a significant role in determining future price trends.

Understanding Bitcoin’s Market Dynamics

In the realm of cryptocurrency trends, Bitcoin’s price fluctuations are often reflective of broader market dynamics. The current environment, characterized by a cautious investor sentiment influenced by external factors like Fed interest rate decisions, highlights the intricate relationship between traditional markets and cryptocurrencies. As Bitcoin navigates through these challenges, its resilience—demonstrated by the recent price bounce—underscores its potential as a stable asset in uncertain economic times.

Moreover, Bitcoin’s recent performance can be viewed within the context of a larger market analysis, where the influence of institutional investors and retail traders is becoming increasingly significant. With the recent gains in Bitcoin price, there is a renewed interest in BTC trading strategies that leverage both technical analysis and market sentiment. As traders adjust their strategies to capitalize on Bitcoin’s movements, understanding the underlying market forces will be essential for forecasting future price trends.

The Impact of Economic Factors on Bitcoin Price

The interplay between economic indicators and Bitcoin price is becoming increasingly evident, especially in light of recent developments in the U.S. equities market. The drop in stocks following the introduction of China’s ChatGPT competitor has raised questions about U.S. competitiveness, prompting a wave of market reactions. Investors are now looking toward Bitcoin as a hedge against such uncertainties, which has contributed to its recent price recovery. Understanding how external economic factors influence Bitcoin can provide valuable insights for both investors and traders.

As we analyze Bitcoin’s price movements, it’s crucial to consider the ongoing discussions surrounding Federal Reserve monetary policy. The decisions made by the Fed can significantly impact Bitcoin’s trading behavior, creating ripple effects across the entire cryptocurrency landscape. With Bitcoin’s current resilience, it will be interesting to see how traders adapt their strategies in response to these economic changes and whether Bitcoin can sustain its position above key support levels.

Bitcoin Support Levels: Key to Future Movement

Support levels play a pivotal role in determining Bitcoin’s future price movement, acting as psychological barriers that can either bolster or hinder its progress. The current analysis suggests that Bitcoin’s ability to maintain support around the $95,000 mark is critical. If BTC can hold this level, it may signal to traders that a bullish trend is likely to continue, thereby attracting more investment and trading activity. Understanding these support levels is essential for anyone looking to navigate the complexities of Bitcoin trading.

Additionally, the significance of these support levels extends beyond mere numbers; they reflect the collective sentiment of traders in the market. A strong support level can create a sense of security, encouraging more investors to enter the market, while a breach of this level may trigger panic selling. As Bitcoin continues to oscillate around these thresholds, traders must remain vigilant and informed about market trends and potential shifts in investor sentiment.

Bitcoin Price Predictions for the Coming Weeks

As we look ahead, Bitcoin price predictions indicate a cautious optimism among analysts. With the cryptocurrency currently trading above the $100,000 mark, many speculate that this rally could continue, especially if Bitcoin can consistently hold above key support levels. Predictions often consider various factors, including market sentiment, regulatory news, and macroeconomic indicators, which can all influence Bitcoin’s price trajectory in the coming weeks.

Furthermore, the predictions are not just based on technical analysis but also the broader context of cryptocurrency trends. The growing acceptance of Bitcoin among institutional investors and the potential for new regulatory frameworks could play a significant role in shaping its future price movements. As analysts refine their Bitcoin price predictions, they emphasize the importance of staying attuned to market developments and adapting strategies accordingly.

BTC Trading Strategies in a Volatile Market

In a highly volatile market, developing effective BTC trading strategies is crucial for both novice and experienced traders. The recent bounce in Bitcoin price offers a unique opportunity for traders to reassess their positions and adopt strategies that align with current market conditions. Utilizing a combination of technical analysis and market sentiment can help traders make informed decisions, maximizing their potential for profit while minimizing risks.

Moreover, traders should consider employing various trading techniques, such as swing trading or day trading, to capitalize on Bitcoin’s price fluctuations. Understanding key support and resistance levels will be essential in crafting these strategies, as they provide critical insights into potential entry and exit points. By continuously monitoring the market and adapting trading strategies to align with Bitcoin’s dynamic price movements, traders can enhance their chances of success in this ever-evolving landscape.

The Role of Market Sentiment in Bitcoin’s Performance

Market sentiment is a powerful force in the world of cryptocurrencies, often dictating the direction of Bitcoin’s price movements. The recent fluctuations in Bitcoin price highlight how quickly sentiment can shift, influenced by news events, economic data, and even social media trends. As traders react to these shifts, understanding the underlying sentiments can provide a competitive edge in predicting future price actions.

Additionally, the influence of social media on market sentiment cannot be overstated. Platforms like X (formerly Twitter) have become hubs for discussions and analyses that can sway trader opinions significantly. Keeping a pulse on these conversations can help traders gauge the overall sentiment surrounding Bitcoin, allowing for more strategic decision-making when it comes to trading and investment.

Upcoming Events That May Affect Bitcoin Price

Looking ahead, several key events could potentially impact Bitcoin price and market dynamics. The upcoming Federal Reserve meetings regarding interest rate decisions are particularly noteworthy, as they can create volatility not only in traditional markets but also in the cryptocurrency space. Traders are advised to stay informed about these events, as they may present opportunities or risks based on how the market reacts to new information.

Additionally, the growing number of cryptocurrency conferences and regulatory announcements can also play a significant role in shaping Bitcoin’s trajectory. Events that foster discussions around cryptocurrency adoption and regulatory clarity can boost investor confidence, possibly leading to upward price movements. Therefore, keeping track of these upcoming events is essential for anyone involved in BTC trading or investing.

Analyzing Long-Term Bitcoin Trends

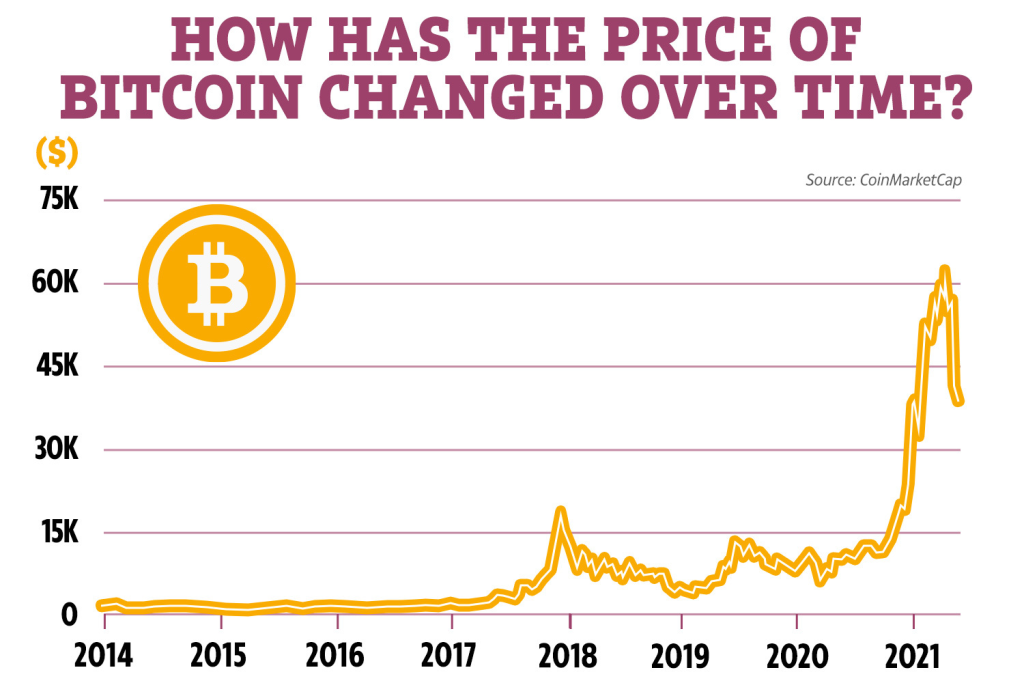

When examining Bitcoin’s price trajectory, it’s essential to consider long-term trends that can provide insight into its future performance. Historically, Bitcoin has demonstrated an ability to recover from downturns, establishing itself as a significant asset in the financial landscape. Current analyses suggest that if Bitcoin can maintain its upward momentum and remain above key support levels, it may set the stage for continued growth.

Moreover, long-term Bitcoin trends are often reflective of broader cryptocurrency market movements, including the rise of altcoins and increasing adoption of digital currencies. As institutional interest in Bitcoin grows, understanding these long-term trends can help investors make strategic decisions that align with their financial goals. By focusing on the bigger picture, traders and investors can better navigate the complexities of the cryptocurrency market.

| Key Point | Details |

|---|---|

| Bitcoin Price Bounce | Bitcoin price surged 5%, recovering above $100,000 after hitting a local low of $97,750. |

| Impact of US Equities | The drop in Bitcoin coincided with a decline in US equities futures due to concerns over US competitiveness after the launch of China’s AI competitor, DeepSeek. |

| Market Analysis | Analysts suggest that maintaining a support level around $95,000 could lead to a bullish outlook for Bitcoin. |

| Q1 Performance | Bitcoin remains over 8% up in Q1, indicating strong market resilience. |

| Federal Reserve Influence | Upcoming Federal Reserve interest rate decisions could affect Bitcoin and crypto market behaviors. |

Summary

The recent bounce in Bitcoin price, which surged back above $100,000, showcases the cryptocurrency’s resilience in a fluctuating market. After reaching a low of $97,750, Bitcoin’s 5% recovery highlights its potential to rebound despite external pressures from the stock market. This situation underscores the importance of key support levels and the ongoing influence of macroeconomic factors such as Federal Reserve interest rates on the crypto landscape.