As the world looks towards the future, the Bitcoin forecast for 2028 is garnering significant attention, with predictions suggesting a staggering price of $500,000. According to Standard Chartered, this optimistic outlook is driven by a confluence of factors, including increased institutional investment in Bitcoin and a decline in market volatility. Regulatory changes under the Trump administration are also expected to facilitate greater access for investors, further fueling this digital currency’s growth. With rising interest from institutional players, the cryptocurrency market is poised for expansion, making the Bitcoin price prediction a focal point for investors. As we approach the end of the decade, understanding these dynamics will be crucial for anyone looking to navigate the evolving landscape of digital assets.

In the realm of digital currencies, the forecast for Bitcoin in 2028 has become a hot topic among investors and analysts alike. With projections indicating a potential peak price of $500,000, many are examining the impact of institutional investments and changing regulations on the cryptocurrency market. The anticipated shifts in oversight, particularly under the Trump administration, could open new avenues for investment and enhance the overall stability of Bitcoin. Moreover, the influx of institutional capital is expected to reduce volatility, making Bitcoin an increasingly attractive asset for long-term portfolios. As we delve into this discussion, the implications of these factors on Bitcoin’s trajectory cannot be overstated.

Understanding Standard Chartered’s Bitcoin Price Prediction

Standard Chartered has made an ambitious Bitcoin price prediction, forecasting that Bitcoin could reach $500,000 by the end of 2028. This projection is grounded in a comprehensive analysis of market trends, including the notable rise in institutional investments and the anticipated regulatory developments under the Trump administration. The bank’s head of digital asset research, Geoffrey Kendrick, highlights that these factors will likely improve investor access and reduce volatility, which are critical for Bitcoin’s long-term stability and growth.

In addition to institutional investments, the launch of the U.S. spot Bitcoin ETF market in January 2024, which has already attracted significant net inflows, is set to play a crucial role in shaping Bitcoin’s future. Kendrick draws parallels between Bitcoin and gold, suggesting that as the ETF market matures, Bitcoin could experience a price surge similar to gold’s historic performance following the introduction of ETPs. With these developments, Standard Chartered’s optimistic outlook indicates a transformative period ahead for Bitcoin, potentially setting the stage for unprecedented growth.

The Role of Institutional Investment in Bitcoin’s Growth

Institutional investment is a pivotal factor in the bullish forecast for Bitcoin, as highlighted by Standard Chartered’s research. With increasing participation from large financial entities, Bitcoin is gaining traction as a legitimate asset class. This influx of institutional capital not only stabilizes the market but also enhances credibility, attracting more retail investors. Kendrick emphasizes that as institutional inflows continue, they will help to minimize Bitcoin’s historical volatility, creating a more predictable investment environment.

Furthermore, the commitment of institutions to Bitcoin is bolstered by advancements in financial products and services, such as futures and options markets. These developments provide investors with more tools for managing risk and gaining exposure to Bitcoin, thus encouraging further investment. As institutional interest grows, Bitcoin’s acceptance in mainstream finance is likely to accelerate, further supporting the projection of reaching $500,000 by 2028.

Trump’s Regulatory Influence on Bitcoin’s Future

The regulatory landscape for Bitcoin is expected to undergo significant changes under the Trump administration, influencing the cryptocurrency’s trajectory. Kendrick notes that regulatory reforms could enhance the accessibility of Bitcoin for both institutional and retail investors. The repeal of certain accounting restrictions, such as SAB 121, has already paved the way for companies to hold digital assets more freely, which is a critical factor in driving institutional adoption.

Additionally, Trump’s directive to explore a national digital asset stockpile could encourage central banks and financial institutions to view Bitcoin as a viable investment option. This shift in perspective is crucial, as it may lead to increased legitimacy and acceptance of Bitcoin in the traditional financial system. As these regulatory changes unfold, they are likely to play a significant role in supporting Bitcoin’s upward price trajectory, with Standard Chartered’s forecast of $500,000 by 2028 remaining within reach.

Impact of Market Infrastructure on Bitcoin Volatility

The infrastructure surrounding Bitcoin is evolving rapidly, contributing to the anticipated reduction in volatility. Standard Chartered’s analysis suggests that improved market structures, such as the introduction of Bitcoin ETFs, will create a more robust trading environment. As these financial instruments become more mainstream, the influx of capital is expected to lead to more stable price movements, thereby increasing confidence among investors.

As volatility decreases, Bitcoin’s appeal as a portfolio diversifier is likely to grow. Kendrick mentions that a decline in volatility will enhance Bitcoin’s position in optimized investment portfolios, particularly as a complement to traditional assets like gold. The potential for Bitcoin to stabilize and maintain its value presents an attractive investment opportunity, aligning with Standard Chartered’s bullish outlook for the cryptocurrency.

Comparative Analysis: Bitcoin vs. Gold Post-ETF Launch

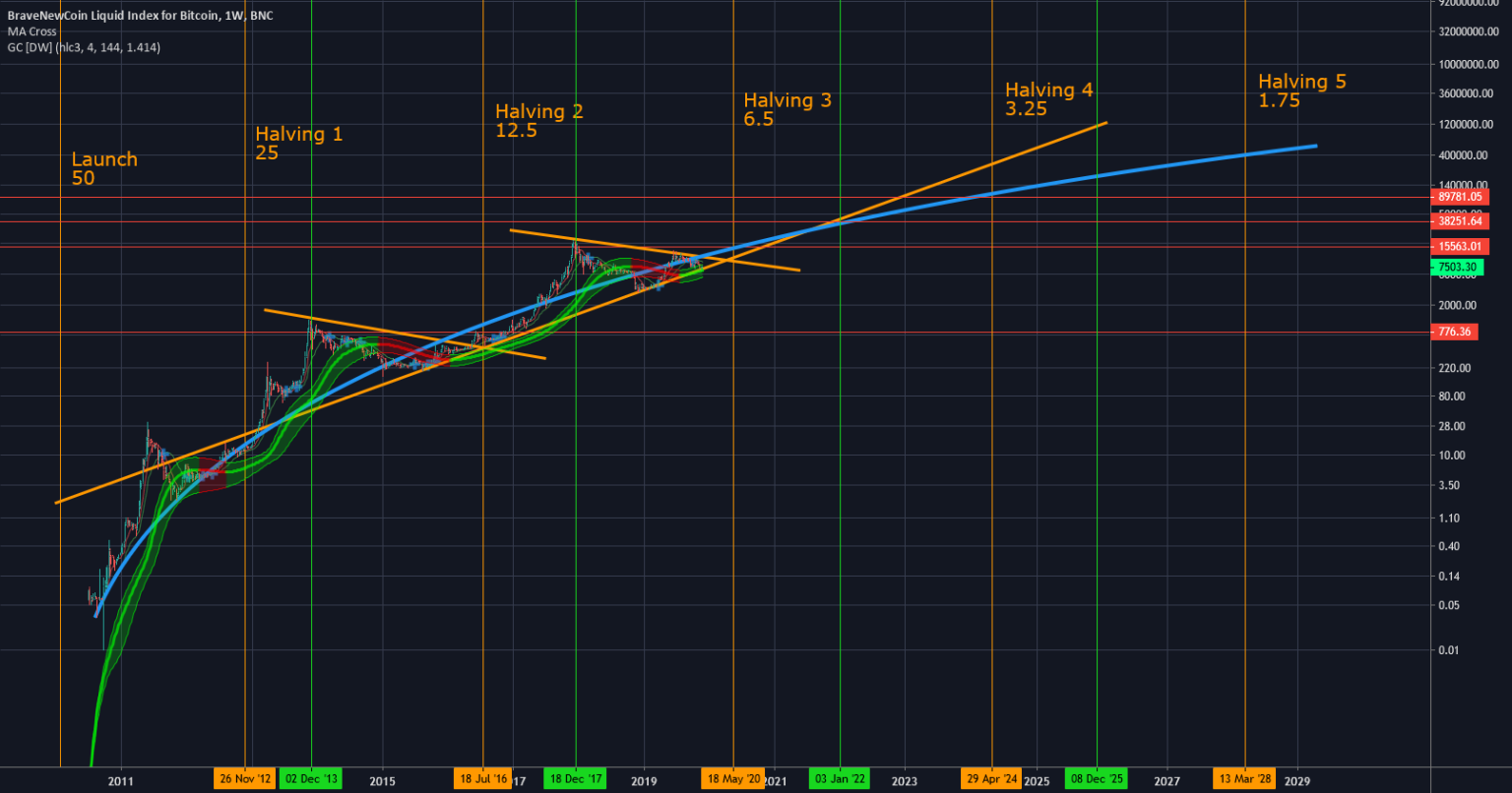

The comparison between Bitcoin and gold becomes increasingly relevant following the launch of Bitcoin ETFs. Historically, gold has shown significant price appreciation after the introduction of exchange-traded products, rising 4.3 times since 2004. Kendrick anticipates a similar trajectory for Bitcoin, predicting that it will experience substantial gains within a shorter timeframe. This comparison underscores the potential for Bitcoin to establish itself as a digital equivalent of gold, appealing to both traditional and modern investors.

As Bitcoin ETFs gain traction, they are likely to attract a broader investor base, mirroring the success seen in the gold market. The institutional investment landscape will further evolve as more investors view Bitcoin as a store of value and a hedge against inflation. This shift in perception could propel Bitcoin’s price towards the ambitious target of $500,000 by 2028, as outlined by Standard Chartered’s forecast.

Future Trends: Bitcoin’s Place in Financial Portfolios

As Bitcoin continues to mature as an asset class, its role in financial portfolios is expected to expand significantly. The integration of Bitcoin into traditional investment strategies is becoming more common, with institutional investors increasingly recognizing its value proposition. Kendrick’s research indicates that as volatility decreases and market infrastructure improves, Bitcoin will likely become a staple in diversified portfolios, enhancing overall returns and risk management.

Moreover, the growing acceptance of Bitcoin by financial advisors and wealth managers highlights its potential as a long-term investment. By incorporating Bitcoin into their strategies, investors can capitalize on its growth potential while balancing the risks associated with its historical volatility. Standard Chartered’s optimistic forecast reinforces the idea that Bitcoin could reach $500,000 by 2028, further solidifying its place in the investment landscape.

Institutional Confidence and Bitcoin Price Predictions

The confidence shown by institutional investors in Bitcoin is a key driver behind the bullish price predictions for the cryptocurrency. As more hedge funds, family offices, and other financial institutions allocate a portion of their assets to Bitcoin, it signals a shift in perception regarding its legitimacy and long-term viability. This growing institutional interest is fundamental to Standard Chartered’s prediction that Bitcoin could reach $500,000 by 2028.

As institutional players leverage sophisticated investment strategies to navigate Bitcoin’s volatility, their participation is expected to stabilize the market further. The introduction of financial products tailored to institutional investors, such as futures and options, will allow for better risk management and price discovery. This enhanced confidence and strategic investment approach could lay the groundwork for Bitcoin’s sustained growth in the coming years.

The Impact of Global Events on Bitcoin’s Trajectory

Global events often play a crucial role in shaping the trajectory of Bitcoin’s price. Factors such as geopolitical tensions, economic crises, and shifts in monetary policy can influence investor sentiment and drive demand for Bitcoin as a safe-haven asset. Kendrick suggests that, amid rising uncertainties in global markets, Bitcoin’s appeal as a digital asset will continue to grow, propelling its price toward the ambitious forecast of $500,000 by 2028.

Moreover, the response of governments to these global events, particularly in relation to regulation and adoption of digital assets, will also impact Bitcoin’s future. As countries explore the potential for national digital currencies and adapt their regulatory frameworks, Bitcoin stands to benefit from increased legitimacy and acceptance. This evolving landscape will be critical for Bitcoin’s growth, as institutional investment and market confidence are bolstered by favorable global conditions.

Long-term Outlook: Bitcoin’s Evolution by 2028

The long-term outlook for Bitcoin is one of significant evolution, with Standard Chartered predicting a remarkable price increase by 2028. As the cryptocurrency matures, it is expected to transition from a speculative asset to a mainstream investment. Factors such as regulatory clarity, institutional adoption, and improved market infrastructure will contribute to this transformation, making Bitcoin more accessible to a wider range of investors.

By 2028, Bitcoin could very well be regarded as a standard asset class alongside traditional investments, with a price trajectory poised to reach $500,000. As the cryptocurrency continues to integrate into the financial system, its adoption by both institutional and retail investors will solidify its status as a key player in the global economy. Standard Chartered’s research serves as a compelling indicator of the potential that lies ahead for Bitcoin in the coming years.

| Key Point | Details |

|---|---|

| Bitcoin Price Prediction | Standard Chartered predicts Bitcoin could reach $500,000 by the end of 2028. |

| Factors Influencing Growth | Increased institutional inflows, declining volatility, and regulatory changes under Trump. |

| Short-Term Volatility | Kendrick acknowledges Bitcoin’s volatility but remains confident in long-term growth. |

| ETF Impact | The U.S. spot Bitcoin ETF, launched in January 2024, has seen $39 billion in inflows. |

| Regulatory Changes | Repeal of SAB 121 and Trump’s digital asset stockpile assessment could influence investment. |

Summary

The Bitcoin forecast for 2028 suggests a remarkable potential for growth, with expectations of reaching $500,000 driven by increasing institutional investment and favorable regulatory changes. As the landscape evolves, the combination of reduced volatility and improved access for investors will likely position Bitcoin as a significant asset in the coming years.