The Bitcoin bull market has captured the attention of investors and analysts alike, especially as it faces potential challenges from external factors like the Trump trade war. Recent volatility in Bitcoin prices, including a sharp drop below $92,000, has led many to question the sustainability of this upward trend within the cryptocurrency market. Despite these fluctuations, Bitcoin demand remains resilient, consistently absorbing market pullbacks even at historically high levels. As we delve deeper into crypto market analysis, the interplay between macroeconomic conditions and Bitcoin price predictions becomes crucial in understanding where the market might be headed next. With the Fear & Greed Index indicating a shift towards greed, many are left wondering if this is a sign of impending growth or a bull trap awaiting unwary traders.

Exploring the current trends in the cryptocurrency landscape reveals that the bullish momentum surrounding Bitcoin is not just a fleeting phenomenon. This digital asset is experiencing a resurgence, prompting discussions about its future and potential market peaks as external influences like tariffs from the Trump administration loom large. Investors are closely monitoring Bitcoin’s performance as they seek to predict price fluctuations and gauge overall market sentiment. The strong demand for this cryptocurrency suggests an underlying confidence, compelling analysts to engage in thorough market assessments. As Bitcoin continues to navigate through these turbulent economic waters, the implications for its valuation and the broader crypto ecosystem are worth examining.

Impact of Trump’s Trade War on Bitcoin Markets

The ongoing trade war initiated by former President Donald Trump has had a significant impact on global markets, including the cryptocurrency sector. As tariffs were announced, investors began to panic, resulting in a dramatic sell-off in Bitcoin prices. The initial reaction to these tariffs caused Bitcoin to drop below $92,000, leading to massive liquidations in the crypto market. This volatility raises concerns about whether the Bitcoin bull market could face an early termination due to geopolitical tensions and economic uncertainties stemming from trade disputes.

Moreover, the uncertainty surrounding Trump’s trade policies often translates to increased volatility in the cryptocurrency market. As traders assess the implications of each tariff announcement, market sentiment can shift rapidly. A notable example occurred after the announcement of a pause on tariffs against Mexico and Canada, which provided a temporary boost to Bitcoin prices. However, with the looming threat of retaliatory tariffs from China, investors remain cautious. Hence, understanding the intricate relationship between traditional trade policies and the cryptocurrency market dynamics is crucial for predicting future Bitcoin price movements.

Understanding Bitcoin Demand Amid Market Fluctuations

Despite recent fluctuations, Bitcoin demand continues to demonstrate resilience. The cryptocurrency has consistently managed to absorb price pullbacks, indicating a solid underlying demand even at historically high price levels. According to Glassnode’s analysis, Bitcoin’s bull market has not yet exhausted itself, and the demand may trigger a ‘second euphoric phase.’ Historical patterns show that after significant corrections, the market often experiences accelerated price performance, suggesting that current investors might be waiting for the right moment to re-enter the market.

Furthermore, the Long/Short Term Holder Threshold is a critical metric that offers insights into Bitcoin’s supply dynamics. This metric reflects the capital rotation from long-term investors to newer market participants, which can significantly influence Bitcoin’s price trajectory. Currently, long-term holders are not offloading their assets, indicating a continued belief in Bitcoin’s potential for higher prices. This sustained demand highlights confidence among investors and suggests that the cryptocurrency market, despite external pressures, may be on the brink of another bullish trend.

Bitcoin Price Predictions for 2025 and Beyond

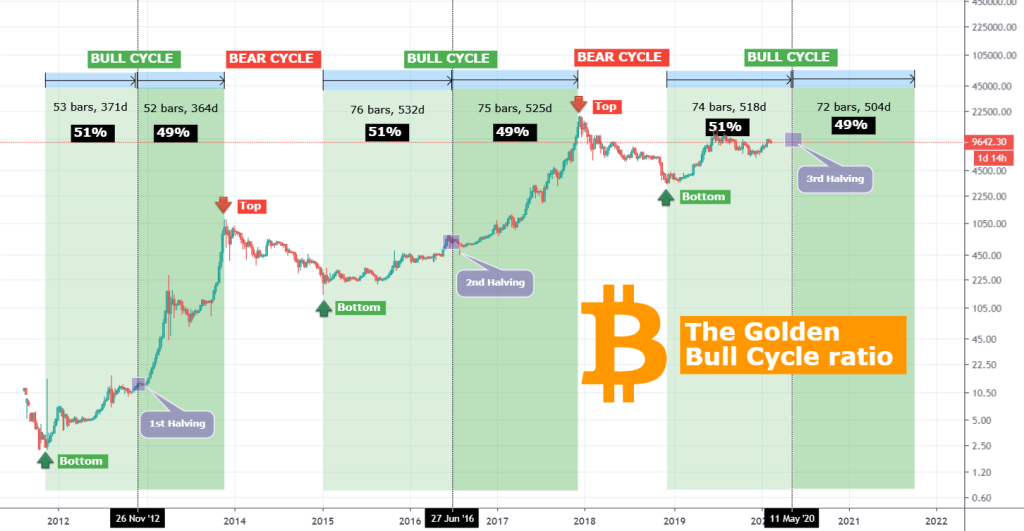

As market analysts evaluate Bitcoin’s trajectory for 2025, many are looking to historical cycles for guidance. The current cycle appears to mirror the 2015-2018 period, albeit with an expected decline in growth ratios due to market maturation. Predictions suggest that Bitcoin could reach between $160,000 and $210,000, reflecting a multiplier of approximately 10x to 13x from its cycle lows of $16,000. This forecast aligns with multiple analysts’ views, emphasizing the importance of capital inflow to sustain prolonged price increases.

However, each Bitcoin cycle is unique, and while historical data provides a roadmap, the future remains uncertain. Factors such as regulatory developments, technological advancements in the cryptocurrency space, and macroeconomic conditions will play pivotal roles in shaping Bitcoin’s price. Investors must remain vigilant and consider these variables when engaging in the crypto market, as they could lead to unexpected outcomes that deviate from previous cycles.

Analyzing the Current State of the Cryptocurrency Market

The cryptocurrency market is currently at a pivotal juncture, with Bitcoin leading the charge amidst ongoing uncertainty from external factors like the Trump trade war. As traditional markets react to tariffs and trade negotiations, Bitcoin shows signs of resilience, suggesting a growing acceptance as a hedge against economic instability. The recent fluctuations and liquidations serve as a reminder of the market’s volatility, but they also highlight the potential for rapid recoveries, reflecting a robust investor interest.

Furthermore, comprehensive market analysis indicates that, despite short-term corrections, the long-term outlook for Bitcoin and other cryptocurrencies remains positive. Investors are becoming increasingly aware of the cyclical nature of crypto markets, where pullbacks can lead to subsequent bullish trends. As they navigate through these waves, understanding market signals and indicators will be crucial for making informed trading decisions in an ever-evolving landscape.

The Role of Onchain Data in Bitcoin Analysis

Onchain data has emerged as a vital tool for analyzing Bitcoin’s market dynamics, providing valuable insights into buying and selling patterns among various investor categories. Metrics such as the Long/Short Term Holder Threshold can help investors gauge market sentiment and anticipate potential price movements. This data-driven approach allows traders to make more informed decisions, especially during periods of heightened volatility induced by external factors like geopolitical tensions.

Moreover, analyzing onchain trends can reveal shifts in Bitcoin demand and supply, which are crucial for understanding the overall health of the cryptocurrency market. As demand remains strong amidst price fluctuations, the data suggests that many long-term holders are confident in Bitcoin’s future potential. This information can assist traders in developing strategies that align with market trends, ultimately enhancing their chances of capitalizing on Bitcoin’s growth opportunities.

Bitcoin Bull Market: Risks and Opportunities

The current Bitcoin bull market presents both risks and opportunities for investors. While the potential for significant returns is enticing, investors must remain cautious of market volatility, especially in light of external factors such as the Trump trade war. The interplay between macroeconomic events and Bitcoin price movements can create unpredictable trading conditions, making it essential for investors to stay informed and adapt their strategies accordingly.

However, the opportunities presented by the Bitcoin bull market are equally compelling. Historical data suggests that after corrections, Bitcoin often experiences substantial growth, indicating that current price dips could represent lucrative buying opportunities. By carefully analyzing market trends and leveraging tools such as onchain data, investors can position themselves to benefit from the potential upward trajectory of Bitcoin in the coming years.

The Fear and Greed Index: A Market Sentiment Indicator

The Fear and Greed Index is a crucial tool for gauging market sentiment within the cryptocurrency landscape. This index provides insights into whether investors are feeling fearful or greedy, helping to identify potential market tops and bottoms. Recently, as the index showed a shift from fear to greed, it indicated a renewed interest in Bitcoin, suggesting that investors may be more optimistic about the cryptocurrency’s future.

Understanding the implications of the Fear and Greed Index can aid traders in making strategic decisions. For instance, periods of extreme greed might signal a market correction, while extreme fear can present buying opportunities. As the index fluctuates in response to market events, such as the impact of the Trump trade war, investors can use this information to navigate the complex dynamics of the crypto market effectively.

Market Resilience and Future Predictions for Bitcoin

Despite recent challenges, Bitcoin has demonstrated remarkable resilience, bouncing back from significant sell-offs. This recovery reflects the underlying strength of the cryptocurrency, fueled by sustained demand and a growing acceptance as a valuable asset class. Looking ahead, many analysts anticipate that this resilience will continue, potentially leading to new all-time highs as market conditions stabilize.

However, predicting the exact timing of Bitcoin’s next peak remains challenging. Factors such as market sentiment, regulatory developments, and macroeconomic trends will influence Bitcoin’s trajectory. As investors remain vigilant, they should consider a range of indicators and analyses to inform their decision-making processes, ensuring they are prepared for both opportunities and challenges in the dynamic cryptocurrency market.

How Geopolitical Events Shape the Crypto Market

Geopolitical events have a profound impact on the cryptocurrency market, influencing investor sentiment and trading behavior. For instance, the Trump trade war has created uncertainties that ripple through financial markets, including cryptocurrencies. As tariffs and trade policies evolve, Bitcoin and other cryptocurrencies often react sharply, reflecting the interconnectedness of global economic conditions and digital asset performance.

Moreover, understanding these geopolitical influences is crucial for investors looking to navigate the crypto landscape effectively. By staying informed about international developments and their potential effects on the market, traders can better anticipate price movements and adjust their strategies accordingly. This proactive approach can help investors capitalize on opportunities while mitigating risks associated with sudden market changes.

| Key Point | Details |

|---|---|

| Bitcoin Sell-off | Bitcoin dropped below $92,000 on Feb. 3, causing $2.1 billion in liquidations. |

| Impact of Trump’s Tariffs | Concerns about the trade war influenced market sentiment and raised fears of a peak in the BTC bull market. |

| Market Recovery | After the initial drop, Bitcoin rebounded due to tariff pauses and positive market indicators. |

| Onchain Data Insights | Strong demand for Bitcoin remains, indicating potential for further price increases. |

| Historical Performance | Previous cycles show that corrections average 25%, followed by price acceleration. |

| Long-Term Holder Behavior | Long-term holders are not selling off their BTC, indicating confidence in future price increases. |

| Price Projections for 2025 | Potential peak price between $160,000 and $210,000 based on historical growth ratios. |

| Market Timing Predictions | Expected market top around September-October 2025, based on RSI and Pi Cycle Top analysis. |

Summary

The Bitcoin bull market is currently facing significant challenges due to external factors such as Trump’s trade war, yet strong demand and historical patterns suggest that a rebound could still lead to new highs. Despite recent sell-offs and market fears, indicators point to continued confidence among long-term investors, which might pave the way for Bitcoin to reach new price milestones by 2025.